Cathay Pacific Airways Ltd has asked all departments to identify savings and efficiencies in an attempt to rein in expenses, as it prepares for a slower rate of growth this year, according to people familiar with the matter.

The Hong Kong flagship carrier is targeting savings of about 5 percent on non-operational staff, tackling head-office expenses in areas like marketing and administration, in part to make room for investments such as AI, said the people, who asked not to be identified talking about confidential information.

As part of the process, some departments and jobs are being merged, and some employees are being redeployed. A limited number of job cuts for Hong Kong and overseas staff will be carried out, some of the people said.

RELATED ARTICLES

- Cathay Pacific ranked among the world’s best three airlines

- Cathay Pacific in talks with shareholders for ‘substantial’ jet order

- Cathay Pacific to cut profit payout to staff by around 50%

- Qatar Airways exits Cathay Pacific stake after eight years

- Cathay Group vows more investment on mainland; to expand staff group

Cathay has said it plans to hire 3,000 people this year, pushing headcount beyond the 34,000 at the end of 2025.

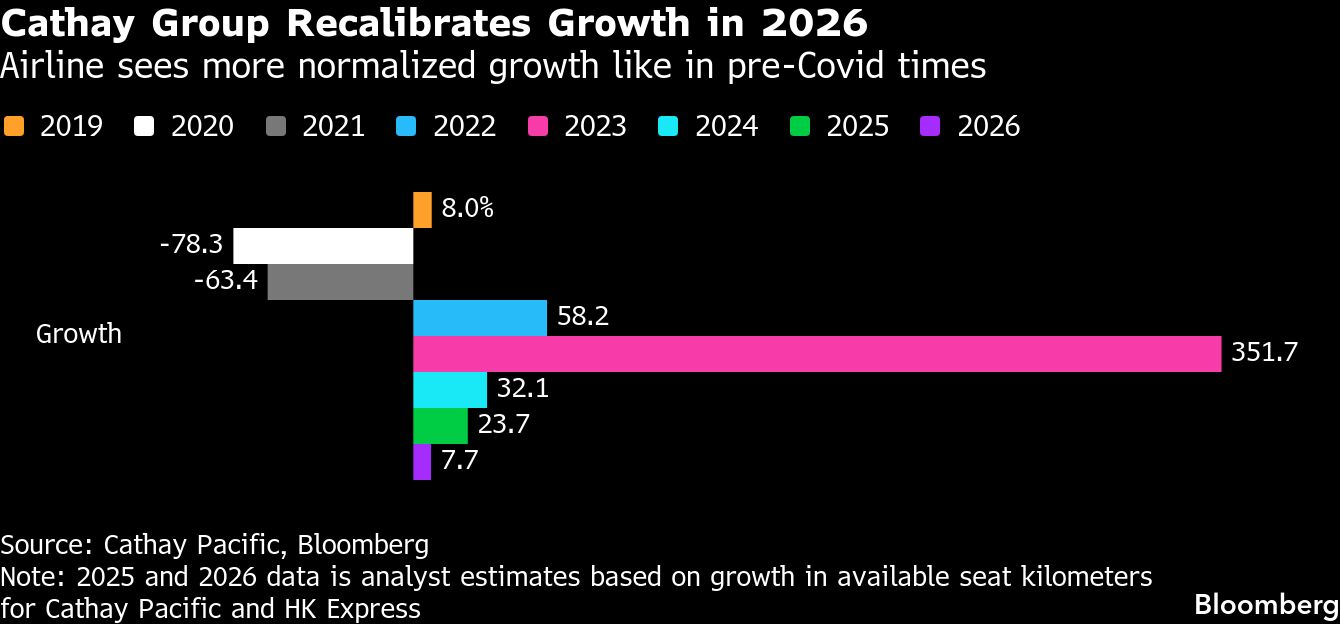

Cathay’s focus on cost comes as the airline expects to pull back growth this year to single-digits for the first time since the pandemic, even as management seeks to maintain solid profit in the face of rising competition.

Chief Executive Officer Ronald Lam Siu-por said in an interview late last year that the airline was entering a period of “more normalized” growth, and he reiterated at an event earlier this week that the airline would be less aggressive on expansion.

That reset comes after a year of rapid expansion, including the launch of 20 new destinations. Analysts expect Cathay, which includes its main brand plus low-cost HK Express, to grow capacity by 7.7 percent this year.

Cathay spokesman Andy Wong said the airline is “dedicated to continuously assessing and refining our operations and organization to ensure optimal delivery of our long-term strategic goals.”

Efficiencies that the airline has already implemented include merging its daily and planning operations teams, and restructured in areas like sales. Last year, the airline combined regional responsibilities such as Southeast Asia and Australia, and relocated its Americas headquarters from San Francisco to Vancouver.

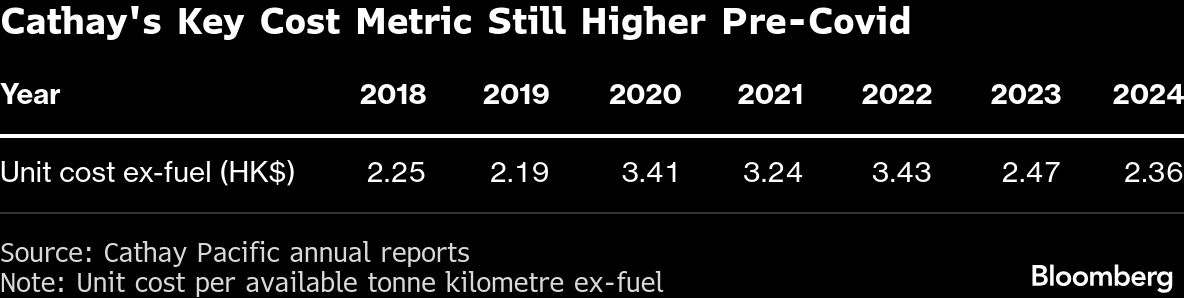

Cathay’s efficiency drive comes as employee numbers approach the level last seen at the end of 2019, even as capacity hasn’t fully returned to the pre-COVID rate. Unit costs per available seat kilometer also remain higher than before the pandemic.

Cathay Group said at the end of last year that it expects 2025 annual profit to be higher than the HK$9.88 billion ($1.3 billion) from a year earlier, which would mark the first year-on-year growth in a decade. In contrast, rival Singapore Airlines Ltd has seen its profit erode on intensifying competition and mounting losses at Air India Ltd, in which it has a 25.1 percent stake.

“Cost discipline will be critical for Cathay to sustain profitability as capacity growth slows,” Eric Zhu, a Bloomberg Intelligence analyst, said. “The group must also manage spending proactively to offset further pressure from declining passenger yields amid rising competition as foreign carriers add capacity.”

The consolidation has also seen personnel redeployed within Cathay’s businesses and at controlling-parent Swire Pacific Ltd, which took the rare step of cutting dozens of jobs late last year.