MiniMax Group Inc, one of China’s largest generative AI startups, surged in Hong Kong after an initial public offering that raised $619 million.

Shares advanced as much as 91 percent in Friday trading. The stock was priced at HK$165 ($21.17) apiece in an upsized offering, with retail investors subscribing to more than 1,830 times the shares available.

Backed by Alibaba Group Holding Ltd and Abu Dhabi’s sovereign wealth fund, MiniMax is among the first of China’s post-ChatGPT generative artificial intelligence firms to go public.

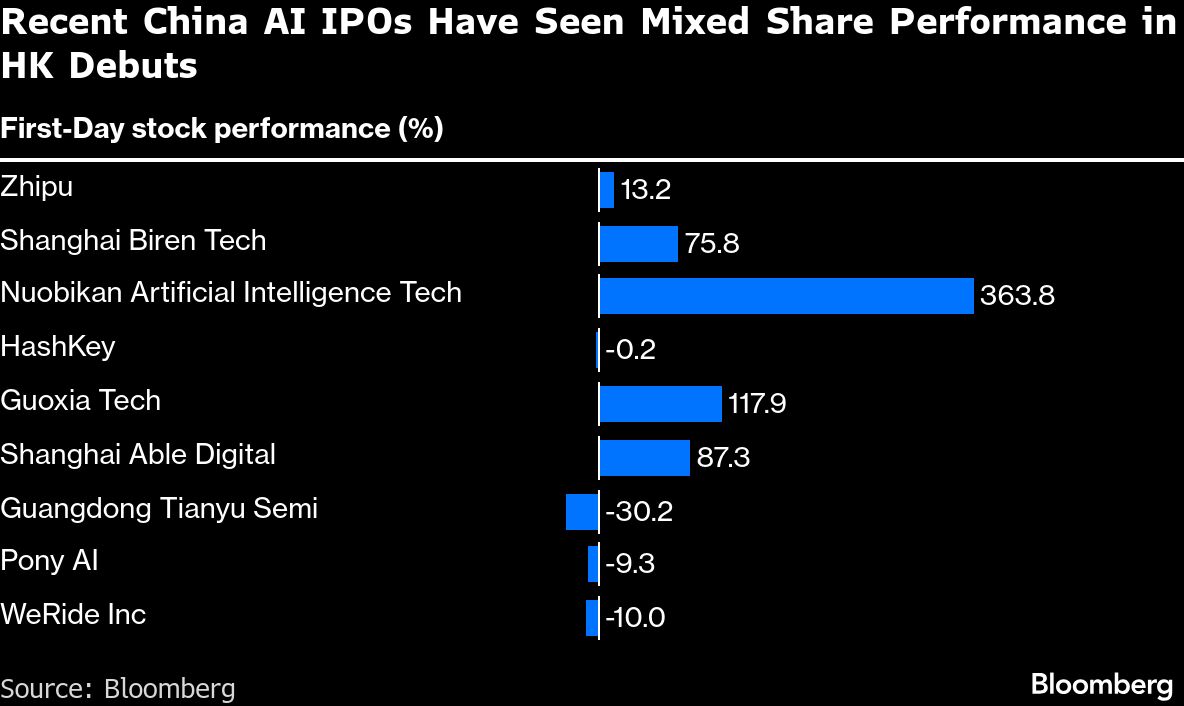

The gains came after rival Knowledge Atlas Technology JSC Ltd, known as Zhipu, delivered a more modest debut in the financial hub on Thursday.

The rally is supported by both short-term speculative buyers as well as longer-term institutional investors, according to Steven Leung, executive director at UOB Kay Hian Hong Kong. There may be some liquidity switching from the US given worries over the AI bubble, he said.

MiniMax’s first-day stock performance serves as a litmus test for whether investor enthusiasm in China’s AI sector — so far concentrated on hardware makers — can extend to software firms.

RELATED ARTICLES

- AI large-model company Zhipu gains more than 13% in HK debut

- Chinese teahouse chain Chagee is said to explore Hong Kong listing

- CK Hutchison ‘picks Goldman Sachs, UBS’ for Watson Group IPO

- Chan: Tech firms making a beeline for Hong Kong

Buoyed by localization demand, chipmakers Moore Threads Technology Co and MetaX Integrated Circuits Shanghai Co surged multifold on their first day of trade, while chip designer Shanghai Biren Technology Co jumped 76 percent jumped 76 percent in Hong Kong. By contrast, Zhipu closed 13 percent higher.

“It is still early in the China AI investment cycle compared to global peers, so it may be difficult for investors to identify winners and losers,” said Marvin Chen, analyst at Bloomberg Intelligence.

“Performance may begin to become more differentiated as the cycle matures.”

Founded in early 2022, Shanghai–based MiniMax has its roots in gaming. The startup is trying to one-up DeepSeek and OpenAI with consumer chatbots at home and abroad.

A devotee of the battle-arena game Dota 2, co-founder Yan Junjie first noticed OpenAI in 2019, when its bots defeated the world’s top human players. Captivated, he devoured the lab’s research papers, prompting a career pivot from computer vision to natural language processing. He secured one of his first checks from Genshin Impact studio Mihoyo, whose founders obsess over using AI to revolutionize gaming. Mihoyo remains a key client.

The IPO prospectus shows the company posted an adjusted loss of about $186 million in the first nine months of 2025.

MiniMax joins a wave of Chinese AI firms that have rushed to raise funds to accelerate their expansion amid support from Beijing to bolster home-grown champions in the sector. About half of the 11 companies that have laid out plans to list in Hong Kong this month are AI companies.