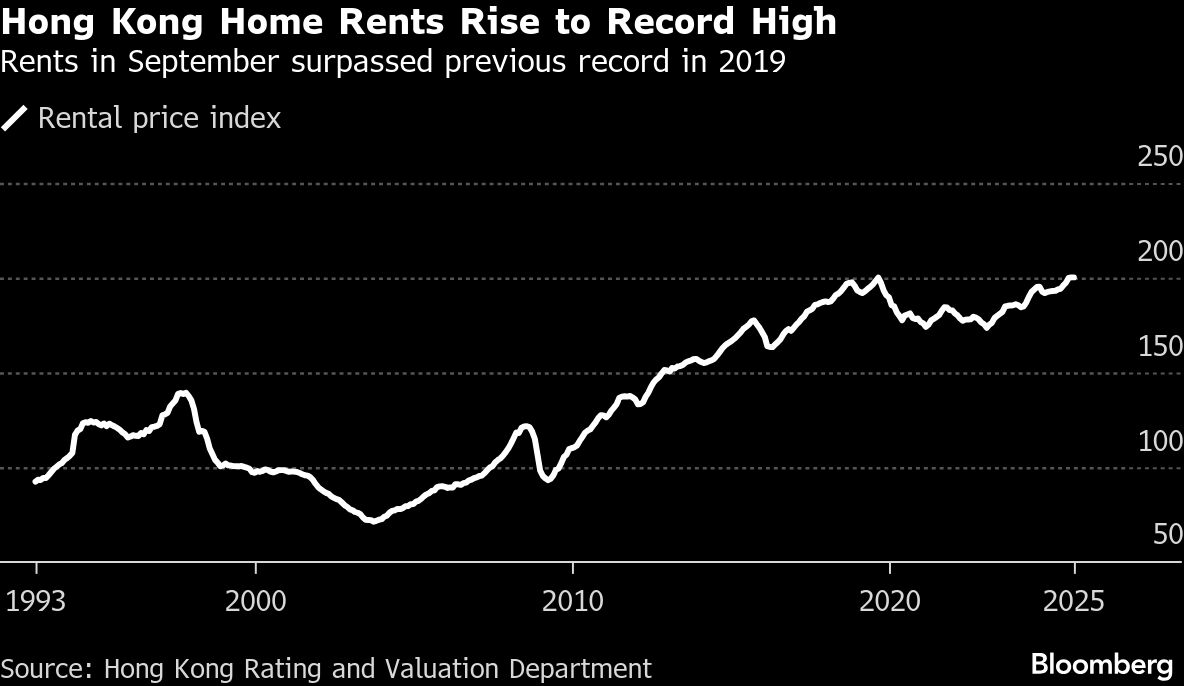

Hong Kong residential rents hit a record high as demand from new arrivals to the city offsets a wider real estate downturn.

The rental price index rose slightly in September from a month ago, to the highest since records began in 1993, and held that level in October, Hong Kong Special Administrative Region government data showed on Wednesday. The growth comes amid a sustained influx of Chinese mainland professionals and skilled labor on new talent programs to the SAR in recent years.

The newly adjusted index value for September released on Wednesday surpassed the previous record set in August 2019.

ALSO READ: Hong Kong's luxury leasing market seen to gain traction

Analysts now expect an improvement in rental returns as lower borrowing costs help to boost investment demand in homes, lifting the sales market.

The rate cut by the Federal Reserve in September has “improved mortgage affordability and boosted buyer confidence,” said Hannah Jeong, head of valuation & advisory services at CBRE Group Inc in Hong Kong. “Now with good yields due to rental increase generated from the residential sector, it can attract both investment and end user demand.”

The arrival of mainland talents in Hong Kong has increased demand for rental housing. The government has approved about 350,000 applicants for work programs aimed at attracting skilled labor to the financial hub in recent years. More than 230,000 have arrived in the city, according to the SAR government.

READ MORE: Report: HK commercial realty set to turn corner

Hong Kong’s official rental index has been increasing for almost a year and is now 0.05 percent higher than the previous record set in the summer of 2019.

Hong Kong’s home prices have been struggling to recover after a four-year downturn. Values remain around 25 percent lower then the peak in 2021, data from Centaline show.