A publicly funded university in Hong Kong plans to increase its private investments to about 10 percent of its endowment portfolio, as part of a strategy to diversify from volatility in public markets.

The Hong Kong Baptist University, which has some HK$8 billion ($1 billion) in endowment investments and cash reserves, is looking to build its exposure to alternatives including in private equities and credit, Kevin Liem, the university’s treasurer, said in an interview with Bloomberg News.

The move contrasts with elite US schools such as Harvard and Yale University, which have been weighing sales of private equity stakes amid political pressure and uncertainty over federal funding. HKBU’s shift is driven by the fading inverse relationship between bonds and stocks, making traditional portfolio strategies less effective and pushing the university to seek new ways to manage risk, Liem said.

HKBU’s endowment is currently invested in equities, bonds and hedge funds. It’s working with about 10 asset managers on these strategies, Liem added.

Liem didn’t provide a time frame for when the private assets will grow to about 10 percent of the endowment’s investments and cash reserves. That proportion would be similar to its current hedge fund exposures.

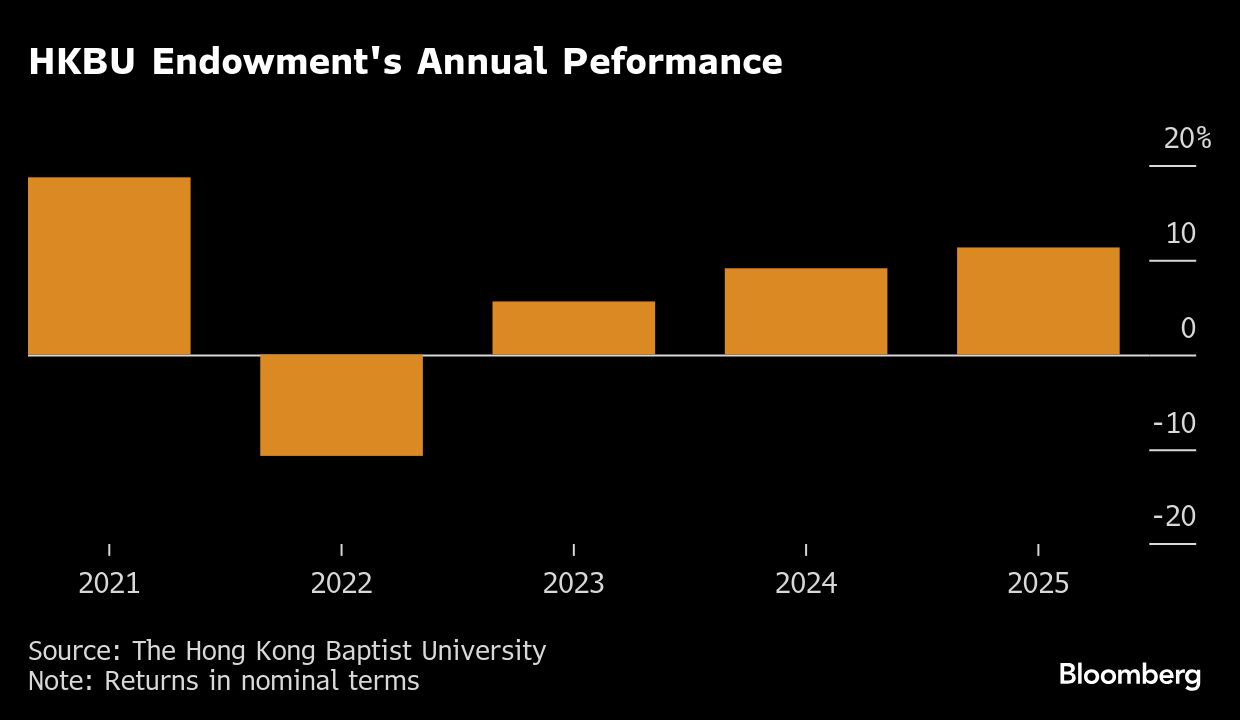

The university’s long-term fund, which reflects the performance of the endowment, recorded an investment loss of HK$600 million in the year ended June 2022. That partly prompted the university to conduct a review of the investment strategies, said Liem.

The long-term fund delivered an annual return of 11.3 percent in nominal terms for the year ended in June, according to the latest financial disclosures.

ALSO READ: HKBU president: AI a booster for culture and creativity

The investment committee is weighing several approaches to begin growing its private alternatives allocations. Options under review include a dedicated mandate or a fund-of-funds structure, Liem said, noting that manager selection has become especially critical following recent turbulence in private credit.

The collapses of auto-loan specialist Tricolor Holdings and car-parts supplier First Brands Group triggered global concerns about the the financial industry’s exposure to private credit markets.

As for investment pacing, the university will gradually build exposures by reallocating money from equities and bonds holdings, Liem said.