“Is it over or not?”

Hong Kong made it to the world headlines days before Financial Secretary Paul Chan Mo-po unveiled the 2024-25 Budget on Feb 28, as investors pondered what the future might hold amid the uncertainties triggered by the “turbulent” geopolitical and macroeconomic climate.

Money speaks louder than words, with investors and stakeholders alike shifting their focus to funds in their new investment thinking.

The current administration’s second budget set aside about HK$10 billion ($1.28 billion) for a program aimed at supporting the development of life and health technology, artificial intelligence and data science, new-energy technology and advanced manufacturing. A further HK$2 billion has been allocated for research in a new health tech hub.

The special administrative region government’s moves have boosted morale in the burgeoning life sciences sector and cheered up professional investors who have set their sights on winning big by spotting the shrouded opportunities in tough times.

One such investor is Da Liu — a former pharmacist and managing director of CR-CP Life Science Fund — who has the serendipity to discover a “gold mine” in life sciences. As the Hong Kong stock market gradually slips into a prolonged bear market that has seen about HK$30 billion in stocks value wiped out in the past three three years, Liu spends most of his time rubbing shoulders with universities, industry entrepreneurs, scientists, private investors, fund managers, and decision-makers of State-owned enterprises in Hong Kong, Beijing and Singapore to promote the life sciences ecosystem among stakeholders.

“Although spotting lucrative unicorns and creating an IPO miracle under the Hong Kong Stock Exchange’s Chapter 18A list (which allows biotech companies with no revenue or profits to be listed on the bourse’s main board) may sound too good to be true, this is exactly what high-tech should be able to bring to the modern era,” he says.

Da Liu has said his newly published book "Life Sciences Unicorns: From a China Investment Perspective" is one of the first of its kind in life science investment in China. (XU WEIWEI / CHINA DAILY)

Da Liu has said his newly published book "Life Sciences Unicorns: From a China Investment Perspective" is one of the first of its kind in life science investment in China. (XU WEIWEI / CHINA DAILY)

Liu, a graduate of St John’s University’s College of Pharmacy and Health Sciences in New York, and an MBA graduate of the Thunderbird School of Global Management, has poured his industry know-how into his recently published book, Life Sciences Unicorns: From a China Investment Perspective. He expects his efforts to nurture a fresh investment focus that will benefit the life sciences industry with promising products developed with innovative technologies.

Liu isn’t the only investor riding the surging wave of the post-pandemic life and health business. In the past decade, the Nasdaq Biotechnology Index and the S&P Biotechnology Select Industry Index have skyrocketed 87.5 percent and 127 percent respectively. In the United States, about half a dozen biotech companies have gone public in the first two months of this year — a significant upturn following a long listing freeze.

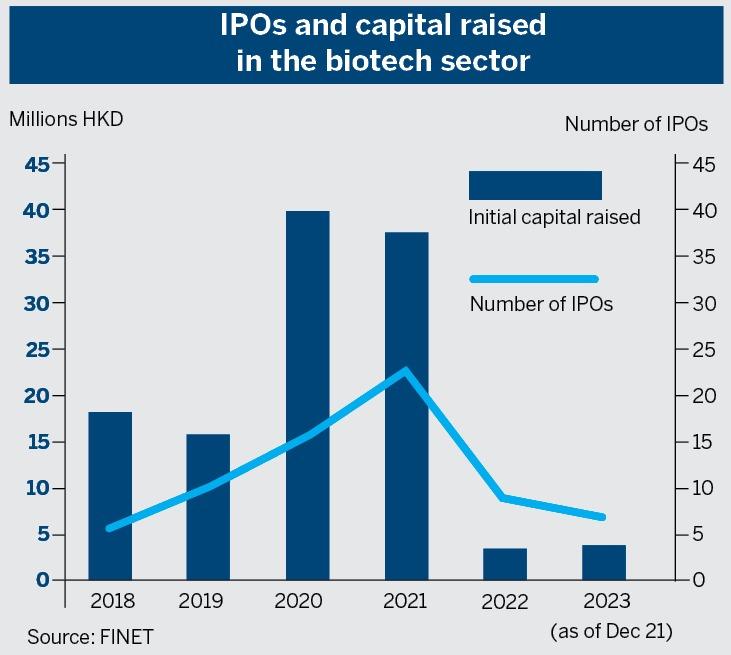

However, Liu and many veteran Hong Kong investors are aware of the strong headwinds in store for the HKEX in an uphill battle. The underperformance of the SAR’s stock market has more to do with capital flows than the actual environment. The total value of local initial public offerings has plunged by nearly 54 percent to a 20-year low of $5.9 billion among 68 listings, according to the latest Refinitiv data.

As the investment climate remains weak, political concerns have grown intense. Liu warns that geopolitics will remain as the chief stumbling block to cross-border investment. While the notion of “ABC” (anything but China) has taken hold among Western investors, anti-China US politicians promote “financial decoupling” to hurt the markets in the mainland and Hong Kong, he says.

He advocates a “paradigm shift” to deal with the crisis, saying that high-tech development will generate values that would translate into economic growth, boosting market liquidity in the long run.

Contact the writers at jessicachen@chinadailyhk.com