Hong Kong, driven by the nation’s technology prowess and the city’s allure for global capital, is likely to see up to 200 companies going public this year, particularly in emerging sectors, heralding the ‘next decade of connectivity’. Luo Weiteng writes.

If what the pundits say is anything to go by, Hong Kong could be on track for another bumper year of listings and keep its coveted crown as the world’s top fundraising venue in 2026.

But stiffer competition will be the name of the game as investors become more fastidious about what, how much and where they’re going to plow their money into.

Whatever the impediments may be, stock gurus are keeping their chins up, joining the chorus of optimism that Hong Kong’s benchmark Hang Seng Index still has room to run.

Banks and advisers, including UBS and KPMG, are seeing more than HK$300 billion ($38.6 billion) up for grabs this year for close to 200 companies seeking to list in Asia’s premier financial hub, buoyed by a strong pipeline of over 300 candidates as of December last year. This would build on nearly HK$280 billion raised in 2025 — a year that vaulted the city back to the top spot in the global initial public offering league table for the first time since 2019.

“Hong Kong had proved itself as a behemoth for global capital formation in 2025 and, with the backing of global hedge funds, that looks set to continue,” says Robin Harris, head of APAC at Ocorian — a global asset servicer to asset managers and owners.

“Hedge funds may be the first to interpret the forecasts, but it hasn’t taken long for others to follow and bask in the warm glow of Hong Kong Exchanges and Clearing’s success.”

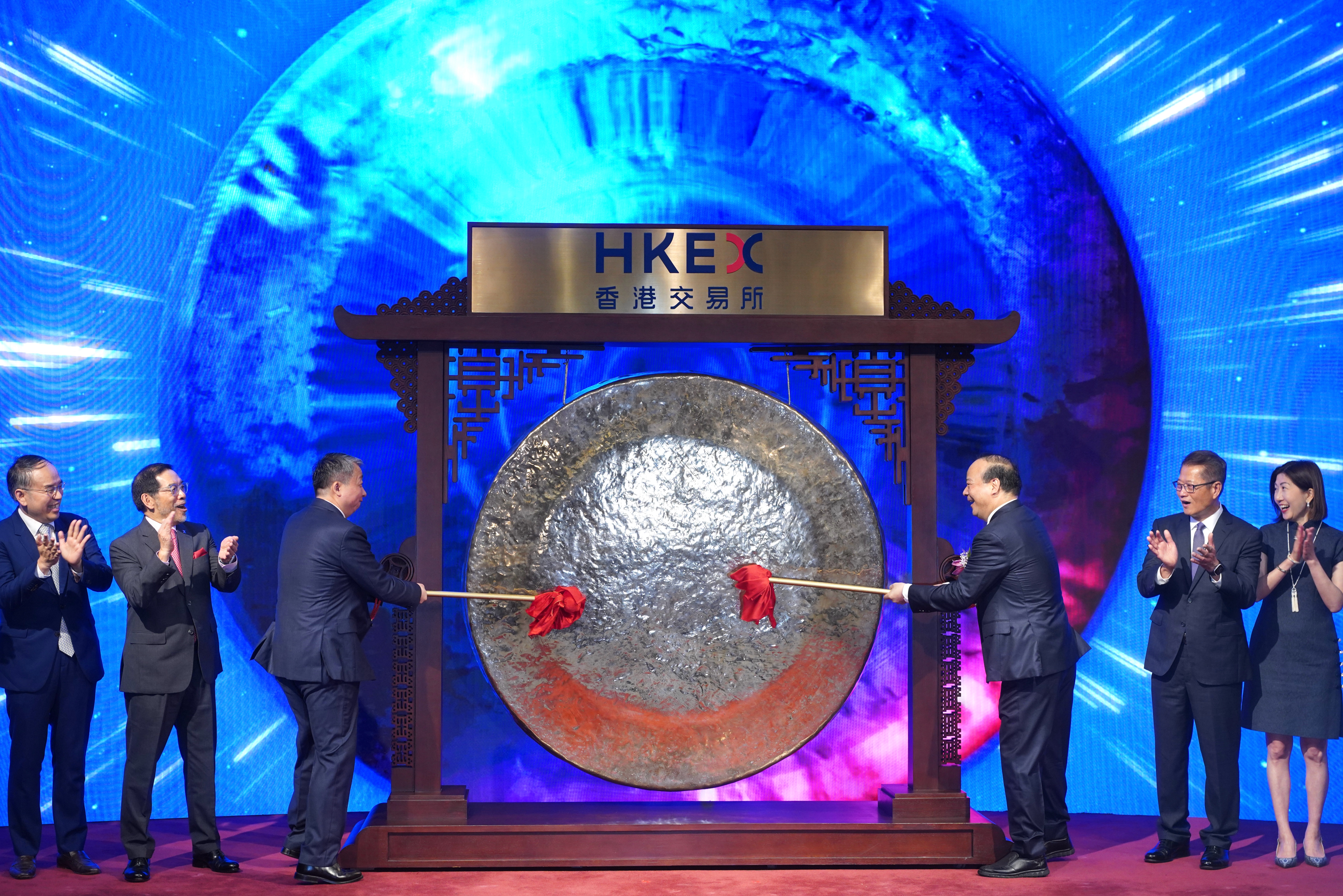

Bonnie Chan Yi-ting — chief executive officer of HKEX, which runs the city’s bourse — points to China’s “DeepSeek moment” as a strong signal of the nation’s prowess in frontier technologies that provide a key “push and pull” for Chinese enterprises from a broad spectrum of sectors making a beeline for the special administrative region.

The SAR’s capital market is becoming structurally more “inclusive” of emerging sectors like artificial intelligence, renewable energy, biotech and digital consumption, aligning with China’s AI ambitions, advances in biotechnology, and efforts to boost domestic demand.

ALSO READ: A+H listing pipeline may help HKEX reclaim No 1 IPO crown, analysts say

Hong Kong hosted 19 “A+H” listings last year — the highest number on record — heralding what Chan sees as the “next decade of connectivity”. Four of the world’s biggest IPOs of 2025 are Hong Kong-based, including Contemporary Amperex Technology, the largest maker of electric-vehicle batteries, which reeled in $5.3 billion.

“A+H listings offer the best of both worlds as they benefit from international and domestic capital, and send a message that the company is globally oriented and ambitious for growth,” says Harris. “Growth is exactly the point.”

As Chinese mainland companies fuel the frenzy with gargantuan deals to power their global expansion plans, Edward Au Chun-hing, southern region managing partner of Deloitte China, sees 2026 as a pivotal year for more “A+H” listings, as well as deals from the high-technology and new economy sectors.

However, he says while at least seven heavyweight IPO candidates, each seeking to raise more than HK$10 billion, are expected to debut this year, the prospects of Hong Kong preserving its IPO crown remain to be seen. United States markets loom as formidable competitors, with Elon Musk’s rocket-manufacturing enterprise, SpaceX, eyeing a listing of over $30 billion, probably this year, in what could be the largest IPO of all time.

At the end of the day, the broader stock market will be crucial in determining how long the IPO boom will be as investors are likely to be more price-cautious and selective before taking the plunge.

ALSO READ: Hong Kong stock market rally seen continuing into 2026

The Hang Seng Index closed the Year of the Snake with a return of nearly 28 percent, outperforming global peers and delivering what Hang Seng Index Company describes as “the best year since 2017”. In comparison, the MSCI World is up more than 19 percent, while the S&P 500 has gained over 16 percent.

Valuation trends

“It should be noted the rally was mostly driven by valuation normalization, with a handful of blue-chip stocks, including Tencent and Alibaba, contributing nearly 70 percent to the gains,” says Kevin Liu Gang, managing director and chief offshore China and overseas portfolio strategic analyst at CICC Research.

With the price-to-earnings ratios of the HSI and the Hang Seng Tech Index now back near historical averages, Kenny Ng, securities strategist at Everbright Securities International, says he believes valuation recovery remains within a reasonable range, and there’s still room to catch up.

“The outperformance of Hong Kong stocks in 2025 can be seen as excessive liquidity chasing a limited pool of assets,” says Liu. “Such logic is here to stay this year.”

That scarcity, however, rotated rapidly across sectors over the course of 2025. Internet-related companies led the rally in the first quarter of last year, followed by new consumption plays in the second quarter and innovative drugmakers in the third, before interest swung back to large-cap internet stocks towards year-end, according to Liu.

“Highly sought-after themes, such as AI, may remain a magnet for capital this year, but expectations are already high,” he notes, warning against renewed fears of AI bubbles that sent jitters across US markets and a fresh bout of geopolitical uncertainties.

Harris interprets Hong Kong’s IPO spree in 2025 as an indicator of broader economic and market trends where the US is “in tentative recovery, and Europe sits in stasis, while Asia is growing and is harnessing industry, innovation and an increasingly global outlook to profit massively and develop global leaders in key fields”.

READ MORE: Strong new economy listings fuel Hong Kong’s IPO market in 2025

As the striking of the gong continues to resonate across the trading halls of Hong Kong’s bourse, and tends to get louder each time, the city’s resurgence as the globe’s top IPO spot points to itself sitting within a broader rebalancing of global capital, and investors increasingly looking beyond a narrow set of markets towards Asia’s growth and industrial upgrading.

Contact the writer at sophialuo@chinadailyhk.com