HONG KONG – Secretary for Financial Services and the Treasury Christopher Hui Ching-yu began his visit to New York on Monday and told the city’s business and finance leaders that Hong Kong remains a magnet for global investment and talent.

Addressing a reception with the Hong Kong community, Hui said that the special administrative region’s economy is recovering strongly, with a real GDP growth of 3.2 percent in 2023, and is expected to grow further at 2.5 to 3.5 percent this year despite the challenging global macro-economic environment.

“Hong Kong remains a magnet for global business, investment, talent, and tourists,” Hui said. “Hong Kong will be at the heart of the continuing eastward shift of economic prospects. We are not only the 'super connector' but also the 'super value-adder', bringing the East and the West together for rewarding opportunities.”

Secretary for Financial Services and the Treasury Christopher Hui Ching-yu said that Hong Kong had a new record of 4,257 start-ups in 2023, with a quarter of them founded by non-locals

He said Hong Kong’s air passenger traffic has rebounded to 80 percent of the pre-pandemic level and the city’s various talent admission programs have attracted over 250,000 applications since the end of 2022, including 70,000 applications submitted through the Top Talent Pass Scheme.

“In 2023, there were over 9,000 companies in Hong Kong with parent companies outside of the city, marking a recovery to the pre-pandemic levels,” Hui said.

Since late last year, some 50 strategic, high-powered companies from around the world, including the US, have chosen Hong Kong to establish or expand their business, investing more than HK$40 billion ($5.1 billion) in total in the SAR in the coming years, and creating over 13,000 jobs, he added.

Hui also said that Hong Kong had a new record of 4,257 start-ups in 2023, with a quarter of them founded by non-locals.

“On the financial services front, we are a leading international asset and wealth management hub in Asia, managing close to $4 trillion in assets at the end of 2022, with two-thirds sourced from non-Hong Kong investors,” he said.

“Hong Kong is home to more than 12,500 ultra-high-net-worth individuals, surpassing any other city globally, and a recent study estimated there are over 2,700 single-family offices in our market,” he added.

Hui began the day by meeting with Global Chief Economist of S&P Global Ratings Paul Gruenwald. He elaborated on the measures taken to maintain Hong Kong’s robust financial system and healthy fiscal condition.

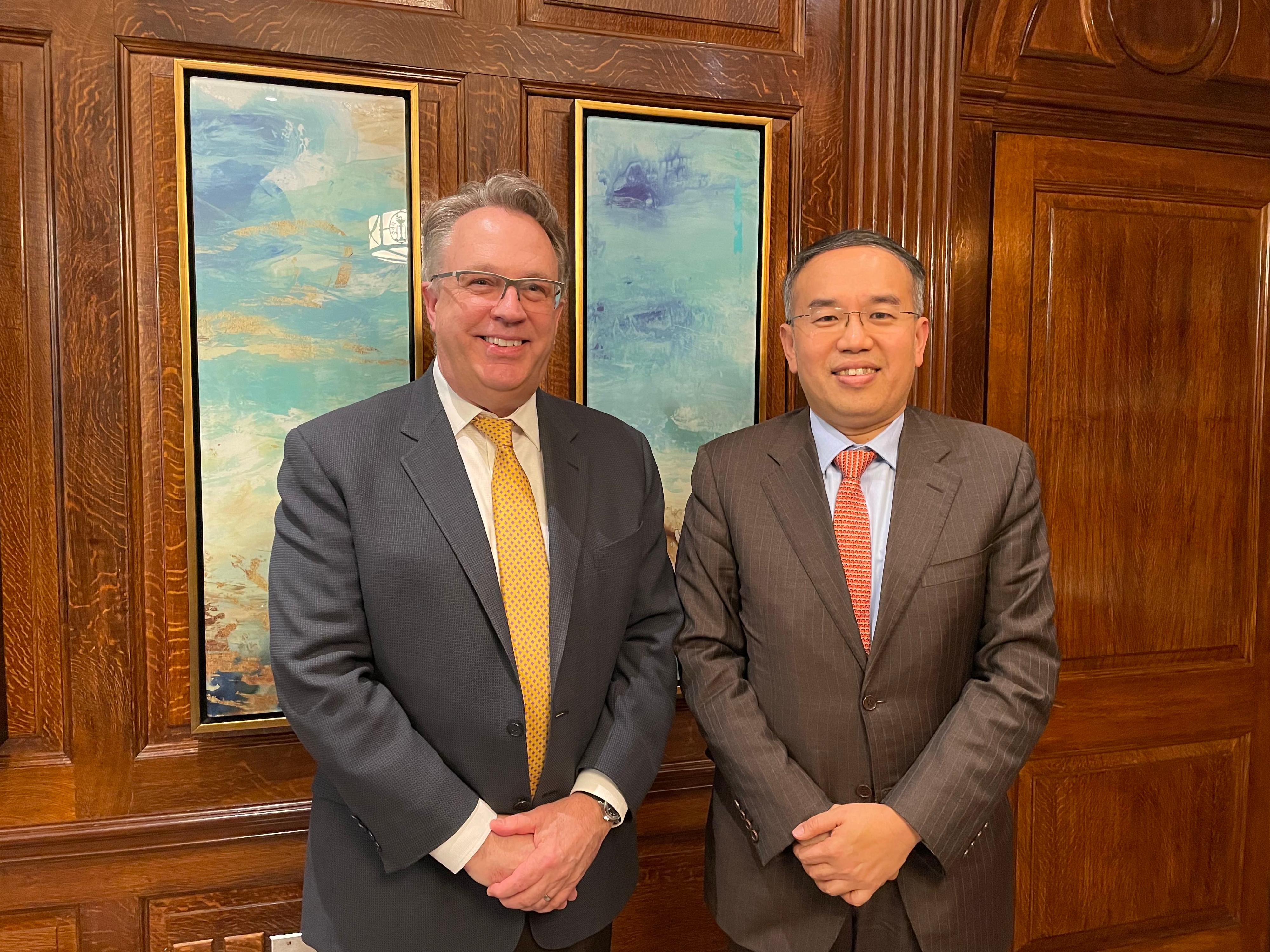

Hui met with President and Chief Executive Officer of the Federal Reserve Bank of New York John Williams and discussed global economic trends and interest rates

The treasury chief then met with President and Chief Executive Officer of the Federal Reserve Bank of New York John Williams and discussed global economic trends and interest rates.

Attending a roundtable luncheon with the National Committee on United States-China Relations (NCUSCR), Hui and NCUSCR President Stephen Orlins had conversations with participants mainly from the financial sector on the economic developments in the Chinese mainland and the HKSAR.

Hui also talked about the roles of a "super connector" and a "super value-adder" played by Hong Kong in the development of the country.

Hui then visited the New York Stock Exchange in the afternoon and met with Vice-President and Global Head of Advisory of the NYSE Chris Taylor, and Will Goodwin, director for operations and the NYSE Institute of the NYSE.

He shared with them Hong Kong's measures to enhance the liquidity and competitiveness of its stock market amid challenges from the external environment.

Hui also met with Justin Kreamer, senior vice-president of partnership department of the New York City Economic Development Corporation, to exchange views on strengthening economic cooperation and developments between the two places.

He will continue his visit to New York on Tuesday and meet with Founder of Bloomberg LP and Bloomberg Philanthropies Michael Bloomberg, join a roundtable discussion regarding Hong Kong's fintech developments, speak at a luncheon co-organized by the Hong Kong Economic and Trade Office, New York, and the Asia Society, and meet with leaders of financial institutions.