HSBC Holdings Plc will start offering tokenized deposits to its corporate clients in the US and the United Arab Emirates in the first half of next year, as banks expand their push into blockchain technology for payments.

The Tokenized Deposit Service allows clients to send money locally and across borders in seconds around the clock, rather than during working hours, Manish Kohli, HSBC’s global head of payments solutions, said in an interview. The system can help big companies better manage liquidity, he added.

“The topic of tokenization, stablecoins, digital money and digital currencies has obviously gathered so much momentum. We are making big bets in this space,” Kohli said.

HSBC’s tokenized service is already available in the Hong Kong Special Administrative Region, Singapore, the UK and Luxembourg, and the bank currently processes transactions in euros, pounds, US dollars, Hong Kong dollars and Singapore dollars. It will add UAE dirhams next year when it expands to the Middle East, Kohli said.

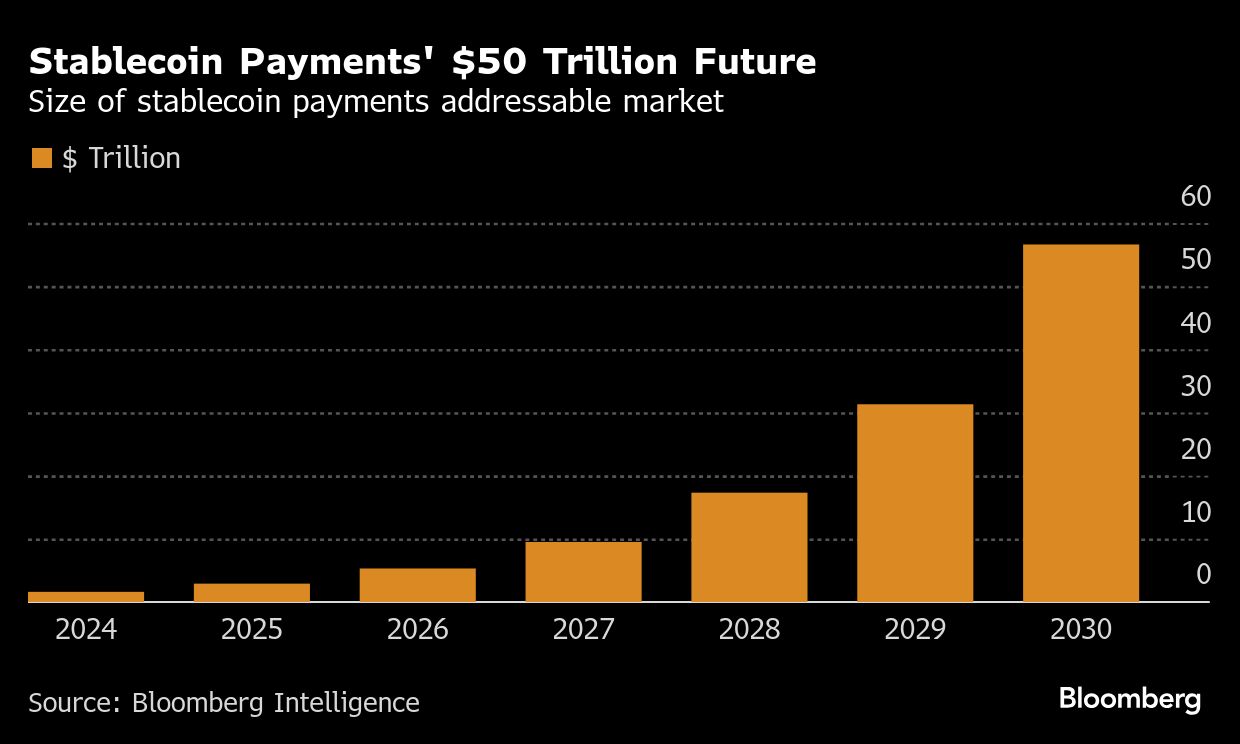

The lender’s move comes as other major banks — including Deutsche Bank AG, Citigroup Inc, Banco Santander SA — explore how digital assets can make payments quicker and more efficient. It also follows the passage of the Genius Act in the US, which sets out rules for stablecoins, another fast-growing category of digital money.

Deposit tokens are digital instruments issued by lenders that represent a claim on existing deposits. In practice, they function as tokenized forms of money already held in bank accounts.

ALSO READ: Experts: HK tokenization shifts from pilots to wider adoption

Unlike stablecoins, which are usually linked to traditional currencies and backed by high-quality liquid assets such as government debt, deposit tokens are created within the existing banking system and can pay interest. This can make them more attractive for clients who hold big amounts of money on their accounts.

Treasury management

HSBC plans to expand the use cases of tokenized deposits in programmable payments and autonomous treasuries, systems that use automation and artificial intelligence to independently manage cash and liquidity risk, according to Kohli.

“Nearly every large company that we have a conversation with, we are seeing a big theme around treasury transformation,” Kohli said.

Other banks including JPMorgan Chase & Co and Bank of New York Mellon Corp are currently looking at or have already launched deposit token services.

Financial firms have spent over a decade experimenting with blockchain, but only a handful of projects have gone live. The activity still pales in comparison with conventional markets. HSBC is one of the world’s largest transaction banking providers and processes around $500 trillion in electronic payments a year. It does not yet disclose volumes on its tokenized deposit service.

Stablecoin exploration

HSBC is also studying the stablecoin industry. The lender is currently in talks with some stablecoin issuers to offer reserve management and settlement account services, Kohli said.

The lender has not ruled out potentially issuing a stablecoin on its own or jointly with other banks in the future, he added.

READ MORE: HSBC 'disbands team focused on managing geopolitical risks'

“It’s something that we would continue to evaluate,” Kohli said. “There are a few things that need to happen, which is the legal framework needs to be clearer.”