Global auditor firm EY has said Hong Kong should press ahead with targeted investments in technology-driven initiatives and the Northern Metropolis development, guided by the country’s 15th Five-Year Plan, even though the city may not achieve a short-term consolidated budget surplus.

The company said it expects the Hong Kong Special Administrative Region government to record a consolidated budget deficit of HK$500 million ($64.1 million) in the financial year 2025-26, drastically lower than its deficit forecast of HK$67 billion announced in February last year. A fiscal reserve of HK$653.8 billion as of 31 March 2026 is expected in the financial year of 2025-26.

It attributed its reduced consolidated budget deficit prediction to a higher-than-expected cut in expenditure, a higher-than-expected increase in stamp duty, profits tax and salaries tax receipts, and a lower-than-expected decrease in land premiums.

It attributed its reduced consolidated budget deficit prediction to a higher-than-expected cut in expenditure, a higher-than-expected increase in stamp duty, profits tax and salaries tax receipts, and a lower-than-expected decrease in land premiums.

Karina Wong, Greater China private tax co-leader and family enterprise leader at EY, said the trend in land premiums over the next financial year depends on the status of Hong Kong’s residential market and the general economy.

“The buoyant equity market will stimulate more corporate investment in Hong Kong. When more global talent settles in the city, this will create demand for housing units, thus incentivizing private developers to have confidence in bidding for residential land,” she said at a press conference on Monday explaining EY’s budget proposals.

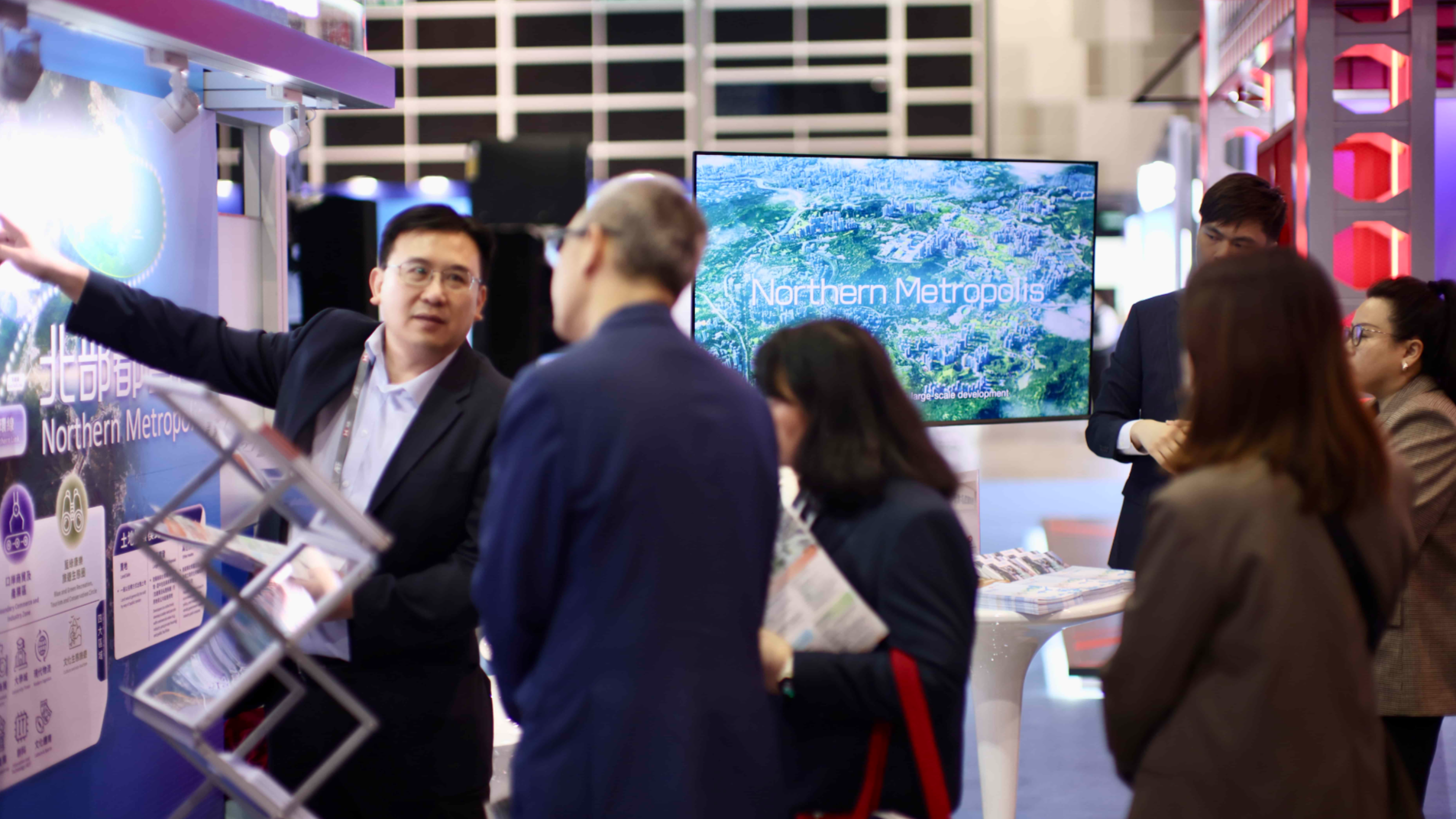

ALSO READ: Officials, LegCo vow more policy support for Northern Metropolis

EY called for the SAR to make long-term investments aimed at making economic growth more inclusive, sustainable and structurally robust. Financing long-term initiatives through debt issuance should be viewed as a tool for enabling sustainable growth, not as a source of concern, the company said.

“Whether debt issuance will affect the pace of attaining a balanced government budget depends on the debt issuance deal number and volume,” said Paul Ho, financial services tax leader for Hong Kong at EY.

EY Hong Kong and Macao Managing Partner Jasmine Lee said: “For this year’s budget, we have focused on investment opportunities such as research and development, intellectual property trading and the Northern Metropolis that Hong Kong can grasp. The government may still need to invest in the short to medium term and the SAR has to balance the need for investment when striving to achieve a consolidated budget surplus.”

To strengthen the effectiveness of current tax legislation, EY recommended that the government explore levying a new digital service tax on non-resident companies providing digital services and content in Hong Kong; extending current stamp duty relief to intra-group transactions in companies not limited by shares and to limited liability companies; and preserving Hong Kong’s compliance under the global minimum tax framework.

EY also highlighted the need to accelerate development of the Northern Metropolis through taxation initiatives, such as providing preferential packages and assistance around land grants, tax, talent and professional support, as well as increasing funding for green infrastructure and climate resilient investments.