As global trade tensions ease, Asia’s policy reforms and domestic economic fundamentals will play a bigger role in investment decisions next year, money managers and analysts said.

Japan and Korea stand to particularly benefit from corporate governance reforms, while India’s fiscal measures are expected to create opportunities, according to funds including Fidelity International and T. Rowe Price Group Inc. Bets in artificial intelligence will broaden with a sharper focus on earnings, according to Principal Asset Management.

Here are some key segments to watch:

Pro-shareholder changes

Corporate reforms will continue underpinning outperformance in Japan and South Korea, analysts say.

In Japan, years of lackluster performance have left mid-sized companies and banks overlooked, but they now stand to gain from both cyclical tailwinds and deeper structural changes, according to Matthew Quaife, global head of multi-asset investment management at Fidelity International.

Buoyed by reform momentum, AI‑related stock gains, and the new prime minister’s growth agenda, Japan’s TOPIX has risen about 20 percent this year.

Japan’s broader market outlook for 2026 looks “compelling”, supported by Tokyo Stock Exchange-led reforms and pro-growth political leadership, Jefferies Financial Group Inc analysts including Shrikant Kale wrote in a note. Their top picks include game developer Nintendo Co, semiconductor tester Advantest Corp and electronics manufacturer Hitachi Ltd.

South Korea is pursuing a similar path with its “Value-Up” campaign to strengthen shareholder returns.

JPMorgan Chase & Co notes that companies such as Hyundai Motor Co and Samsung Life Insurance Co are already making progress. The KOSPI Index has been among the world’s best-performing major benchmarks, up nearly 70 percent this year.

Singapore is also rolling out similar initiatives to boost market appeal, JPMorgan noted, citing Keppel Ltd as a stock to watch.

Sustained AI spending

Taiwan Semiconductor Manufacturing Co and SK Hynix Inc have been tapped as Asia’s top picks for next year by JPMorgan. Their chips will largely remain “under-supplied” through much of 2026, Wendy Lu, a JPMorgan strategist, said.

TSMC has jumped 33 percent for the year so far, while SK Hynix is up 217 percent.

ALSO READ: AI investment to keep rising and boost world economy, OECD says

Investor enthusiasm for AI also has been underscored by high-profile listings in Shanghai, such as Moore Threads Technology Co and MetaX Integrated Circuits Shanghai Co, which drew heavy oversubscription.

“Technology remains a critical driver of performance,” according to Chris Leow, CIO Asia equities at Principal Asset Management, adding the real test is Asia-based companies’ ability to turn promise into earnings.

A diversified approach in AI investing — spanning large tech platforms and supply-chain manufacturers in South Korea — should be favored, Leow said.

Diversifying AI risk

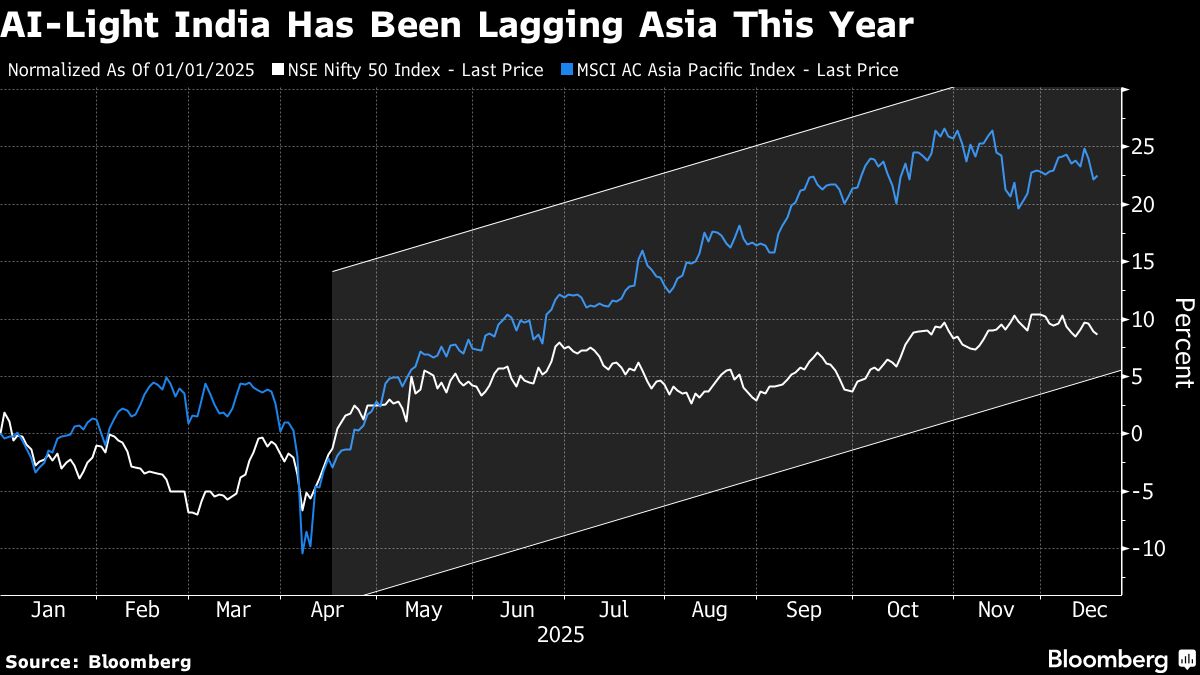

With AI valuation concerns lingering, investors are seeking diversification. That search could spill into emerging markets less tied to sector swings, such as India.

Nomura Holdings Inc strategist Chetan Seth advises Asia investors to balance exposure with overlooked non-tech markets in next year’s allocations. CG Power and Industrial Solutions Ltd and Godrej Consumer Products Ltd were among the Indian firms added to Nomura’s core Asia ex-Japan long-only model portfolio.

Nomura also remains overweight on several Korean power equipment and defense stocks, highlighting Hyundai Rotem Co and Hyosung Heavy Industries Corp among key picks.

Indian valuations remain comparable to the S&P 500, unusual for an emerging market, said Agnes Ng, portfolio specialist at T. Rowe Price. Valuation “is quite amazing,” she added.

Asian bank bonds

Some higher‑risk bonds from Asian banks outside Japan are offering yields of about 6 percent and look promising, said Owen Gallimore, APAC head of credit analysis at Deutsche Bank. He favors the region’s Additional Tier 1 (AT1) subordinated notes from these banks that can be called in the near future.

They are perpetual bank debt and have no fixed maturity, but the issuer has the option to redeem them at set dates.

Korea, India bonds

After a sharp sell-off, Korean government bonds are drawing renewed interest from global fixed-income investors heading into 2026.

The Bank of Korea has kept its policy rate steady in the past few meetings. But as the market starts pricing in potential rate hikes amid a cautious global economic outlook, value is emerging at the front end of the curve, Vincent Chung, portfolio manager at T. Rowe Price, said, adding he doesn’t see hikes as the most likely scenario for now.

Potential inclusion of Korean bonds in FTSE Russell’s World Government Bond Index in April could be another catalyst. Yields on its 10-year benchmark bond have risen 55 basis points to 3.31 percent so far this year.

Fidelity International has noted that demand for high-quality sovereign local currency bonds like South Korea’s should rise as investors diversify and Asia’s policy stance eases amid slowing growth and subdued inflation.

Indian bonds continue to show strong fundamentals, with easing bias and fiscal discipline expected attract more investors, said Deepali Bhargava, regional head of research for Asia-Pacific at ING Bank.

READ MORE: Global alternatives investment gains steam, HK takes regional lead

Among high-yielders, the India rupee remains the standout, also supported by global supply‑chain diversification, she added.