Stock rally in the Hong Kong Special Administrative Region faces a looming test, as year-end expirations of share‑sale restrictions threaten to spur volatility and prompt investors to lock in gains.

A total of 28 companies that listed in the city over the past year will see selling curbs on some early investors — and others including management and controlling shareholders — expire between Wednesday to year-end, potentially freeing up stock worth about HK$193.8 billion ($24.9 billion), according to Bloomberg-calculated data based on Tuesday’s closing prices.

The hefty total reflects a banner year of listings in the HKSAR. Yet the surge also carries drawbacks, flooding the market with new shares just as momentum fades amid global risk‑off sentiment and questions over valuations. The Hang Seng Index, while still up 29 percent this year, is on track for its biggest weekly loss in a month, as Federal Reserve policy uncertainty weigh on sentiment.

“Lockup expirations represent a clear risk factor for Hong Kong equities before year-end,” said Ravi Wong, first vice-president at Yan Yun Family Office (HK) Ltd. “It’s normal for investors to take profits after this year’s gains, whether at the stock level or across the broader market.”

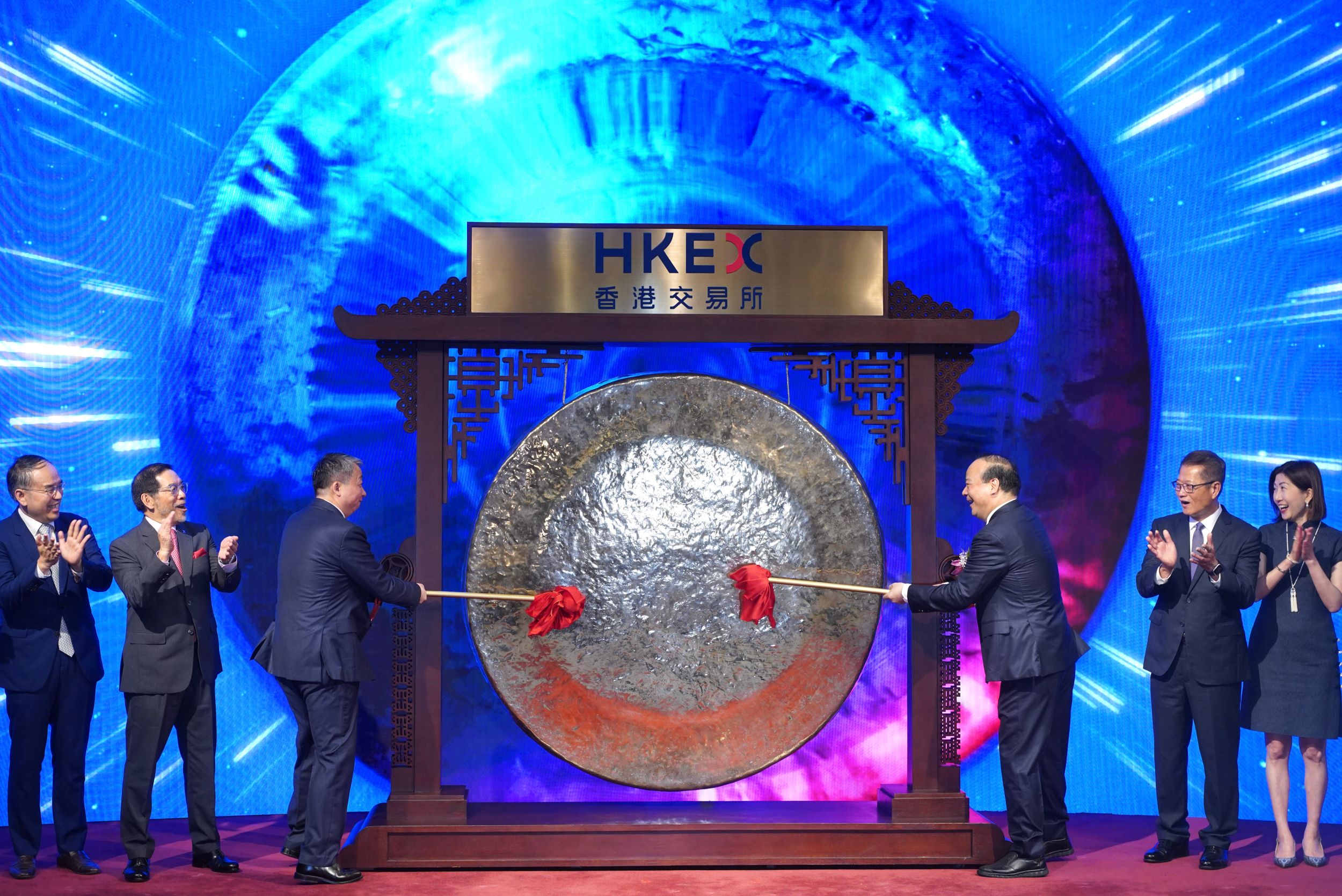

ALSO READ: HKEX sees record surge in listing applications

The HKSAR’s listings market is on track to end 2025 at a four‑year high, with proceeds potentially topping $40 billion, Bloomberg Intelligence estimates.

The 28 companies facing upcoming lockup expirations have seen their H-shares in the HKSAr climb an average of 95 percent since listing, Bloomberg-compiled data shows. TransThera Sciences Nanjing Inc leads the pack with a surge of about 1,430 percent this year.

Downward pressure is expected to be particularly acute for firms that also trade their A-shares on the Chinese mainland and whose H-shares currently command a premium, said Kenny Ng, a strategist at China Everbright Securities International.

Among dual-listed stocks, mainland battery giant Contemporary Amperex Technology Co Ltd and Jiangsu Hengrui Pharmaceuticals Co continue to trade at an H-shares premium over their A-shares.

ALSO READ: Buoyed by blockbuster HK sale, CATL earnings beat estimates

CATL’s shares listed in the HKSAR dropped as much as 7 percent Thursday morning after selling restrictions on some early investors in its May listing expired on Wednesday.