Hong Kong’s finance chief has called on all member economies of the Asia-Pacific Economic Cooperation to safeguard a rules-based multilateral trading system and to work together in promoting sustainable regional economic growth.

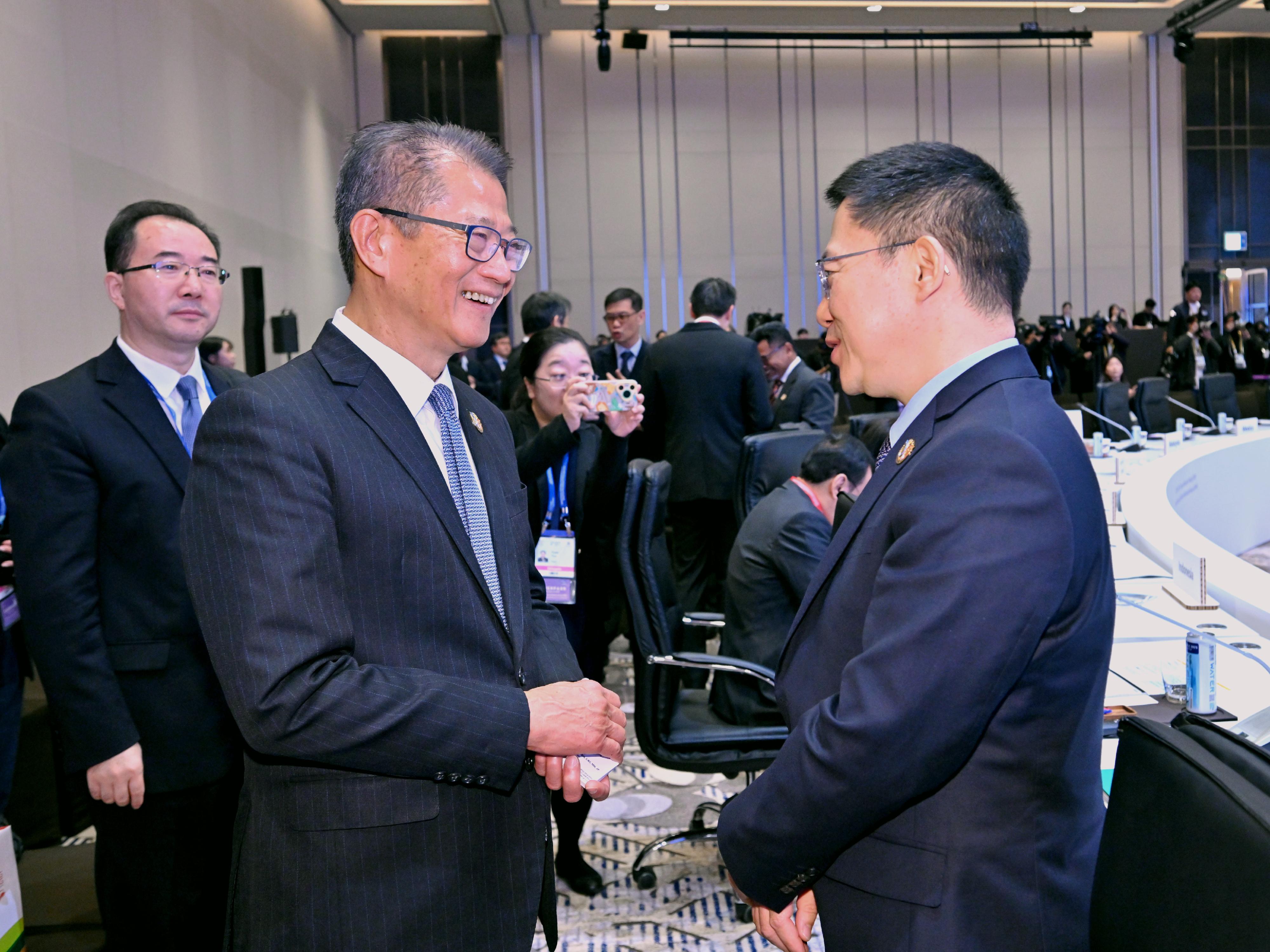

Paul Chan Mo-po made the call while attending the APEC Finance Ministers' Meeting in Incheon, South Korea on Tuesday.

Global growth momentum has weakened amid rising challenges from unilateralism and tariffs, he said during a session on the economic outlook.

The global economy is facing heightened uncertainty, with some economies having to choose between cooperation and coercion, as well as between shared prosperity and narrow self-interest, he said.

RELATED ARTICLES

- CE: HK firmly backs rules-based multilateral trading system

- HK urges boosting ADB cooperation amid global trade disruptions

- Yau: HK firmly supports rules-based multilateral trading system

- WTO members commend HK for its free trade regime

Against this backdrop, Hong Kong, China, remains firmly committed to upholding a free and open trade and investment environment, providing global enterprises and investors with a stable, consistent, and predictable business environment, he said.

This year's meeting is focused on key issues, including the economic situations and outlook, regionally and globally, digital finance and the fiscal policies of member economies.

During a session on digital finance, the financial secretary talked about how blockchain technology and artificial intelligence are creating rapid advances in digital financial services. These technologies not only improve efficiency and reduce costs, but also play a key role in driving financial inclusion, he added.

While sharing key observations on developing a robust fintech ecosystem, Chan, drawing on the special administrative region’s experience, said financial innovation should serve the real economy.

Strengthening data connectivity through public-private partnerships is essential to promoting inclusive and accessible financial services, he said, referring to the Commercial Data Interchange (CDI), a platform launched by the Hong Kong Monetary Authority to enable small and medium-sized enterprises to share business data with banks to facilitate credit assessment.

He also stressed the need for regulators to encourage innovation to drive market developments while maintaining effective oversight.

Chan, in this connection, said the SAR’s financial regulatory bodies offer regulatory sandboxes that allow financial institutions and tech firms to test innovative fintech solutions, with feedback from regulators to help refine and improve these solutions before full-scale implementation.

In light of the increasingly widespread application of digital assets and AI in financial services, economies should strongly emphasize ensuring that such innovations are responsible and sustainable – including the need to safeguard investor interests and maintain financial stability, he said.

Hong Kong is actively engaged in cross-border cooperation and policy dialogue on digital finance and stands ready to deepen collaboration with regional partners in these areas, he added.

Speaking at the session on fiscal policy, he shared Hong Kong’s economic strategy, which includes solidifying its strengths as an international financial and trading center, while fostering the growth of emerging industries such as innovation and technology.

The finance chief also outlined the HKSAR government's fiscal consolidation plan, which focuses primarily on containing expenditure growth, complemented by modest revenue measures based on user-pay and affordability principles.