More than 200 firms are lining up to go public in the Hong Kong Special Administrative Region, adding to a strong year for stock sales in the Asian hub, the city’s financial secretary said.

The IPO pipeline is “very strong”, Financial Secretary Paul Chan Mo-po told Bloomberg Television in an interview from New York. “For mainland companies going global, using Hong Kong as a platform to raise the funds and to employ the talents to help them in their overseas expansion is a very good business proposition.”

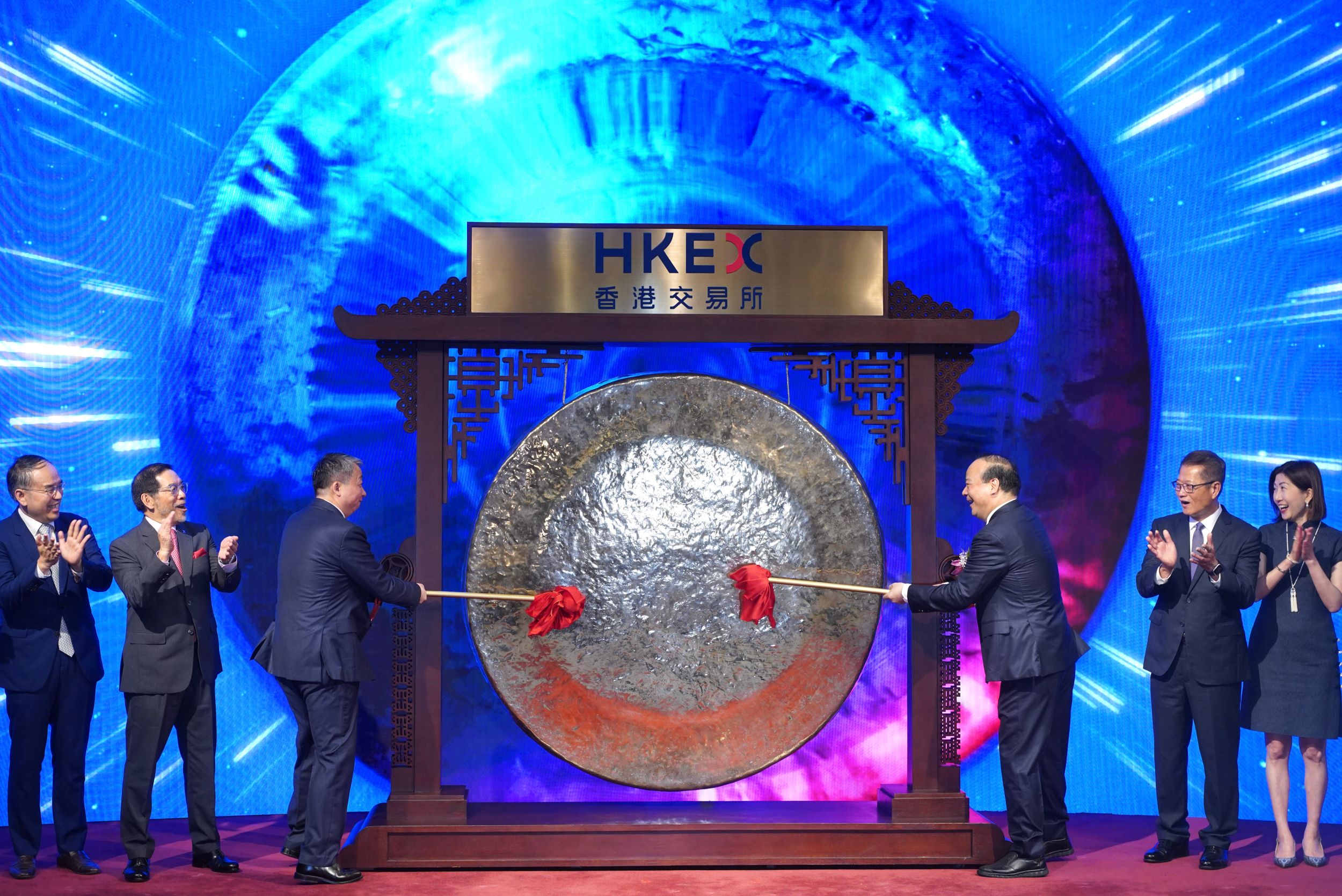

The HKSAR has had a banner year for initial public offerings, as more Chinese mainland firms list in the financial hub and stocks rebound. Equity sales — comprising IPOs, primary placements and block trades — raised the most in four years in the third quarter, data compiled by Bloomberg show. The three-month haul exceeded proceeds for all of 2024.

The market’s revived hype has attracted major listings, including battery maker Contemporary Amperex Technology Co and mainland miner Zijin Gold International Co.

The stocks in the HKSAR have surged since late last year after the mainland reiterated support for the city. The benchmark Hang Seng Index has gained 29 percent in 2025, among the world’s best performing developed markets.

Global investors are helping drive the rally, Chan said. Half of the trading is coming from Europe, the US, Middle East and Asia, with the other half from the mainland, he said.

ALSO READ: Chan: HK reigns as global IPO leader with $19b raised

Bankers summit

Meanwhile, the Hong Kong Monetary Authority is hosting another summit for global bankers next month.

At the moment, there are about 100 people at the chief executive officer or chair level who plan to attend, Chan said.

“The response so far has been overwhelming,” he said. “This is a must go event in Asia for business leaders.”

HSBC vows no layoffs after Hang Seng deal

Chan also said HSBC Holdings Plc told the government that “substantial investment will be made” in the “billions of dollars” in the HKSAR during its proposed privatization of Hang Seng Bank Ltd.

The investment will be spent over the next few years in areas like customer services, technology and boosting the private wealth business, he added.

“According to what they have told us, there will be no layoffs,” Chan said.

The $14 billion buyout proposal, announced last week, was a rare big bet by the London-based bank. The proposed deal has been widely seen as a response to Hang Seng’s high levels of bad debt, which HSBC has been pushing the subsidiary to offload. HSBC Chief Executive Officer Georges Elhedery rejected the connection however, saying it’s “very much” an investment for growth.

Even before the proposed privatization, Chan said he believed Hang Seng’s book fully provided for the provisions irrespective of their loans to commercial related properties.

ALSO READ: HSBC asks Hang Seng Bank to clean up bad Hong Kong property debt

As to whether Hang Seng could be sold at some point in the future after its privatization goes through, Chan said it was a matter for the bank to decide but that, “this has not been made to us as a plan”.