Voices are growing louder among Hong Kong’s political and business elite for the city to play a greater role in driving the NewSpace economy as the next stage of economic growth. Jessica Chen reports.

Editor’s note: The burgeoning NewSpace economy in Hong Kong represents an exciting frontier of innovation, investment, and professional services. The first article in this series explores the city’s strategy to become a key hub in the global space economy.

Overcrowded Hong Kong has long been entangled in a protracted battle for space. Its tense way of life, the incessant hustle and bustle, exorbitant home prices and an acute scarcity of land are nothing new, with residents craving for more space to stretch out away from the city’s notorious “shoebox” homes.

As the local stock market strives to bounce back from a 10-year low in 2023 and prides itself on clinching the top spot in the world’s initial public offering rankings this year, farsighted stakeholders are aiming sky-high — looking to space — for the next stage of economic growth.

Strategic space initiative

Legislators, scientists, and potential investors in the Hong Kong Special Administrative Region were elated when the 2025 Policy Address took a leap skyward. Stephen Wong Yuen-shan, inaugural head of the Chief Executive’s Policy Unit, told China Daily that the government meant to “lay a foundation” for the future, or the “NewSpace economy”.

The stakeholders were aiming high and expecting the policymakers to map out a holistic framework for the NewSpace economy that would make the most of the HKSAR’s entrenched strengths — financial expertise, technological prowess, a robust legal infrastructure, and open market access to the Chinese mainland and the world.

READ MORE: HK focuses on economy, livelihoods

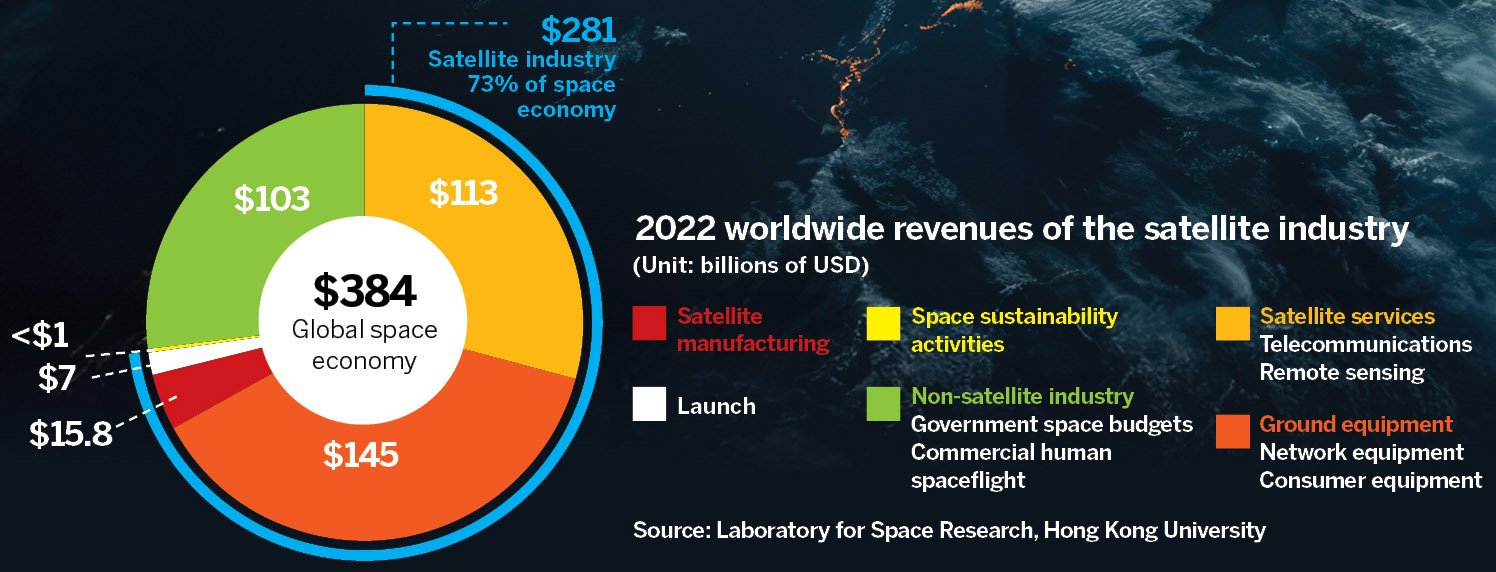

“The NewSpace economy is not about launching rockets or advancing into the outer space with cutting-edge technology,” says Quentin Parker, a space scientist at the helm of a team of 75 members from 13 countries and regions at the University of Hong Kong’s Laboratory for Space Research.

“NewSpace” refers to the emergence of the private space industry, spanning areas like private launch companies, small satellite constellations, or even suborbital tourism, says Parker, who set foot in the HKSAR a decade ago and now calls it his home.

The NewSpace economy differs from the traditional “space economy” in two key aspects — the predominant involvement of private players, the commercialization of the sphere below the medium earth orbit, or the near-Earth space spanning from the ground to 35,786 kilometers. At 35,786 kilometers above, a satellite travels at the same rotational speed as the Earth, enabling critical services like telecommunications, weather monitoring, and global positioning.

The booming low-altitude economy is part of the NewSpace economy, but the latter involves a wider range of businesses with a greater impact on Hong Kong’s small, free-wheeling economy than the former does. Literally, all commercial activities associated with satellites in the MEO, or low earth orbit, such as the global positioning systems, space travel and space manufacturing, fall under the NewSpace economy’s umbrella.

“If we seize these opportunities, Hong Kong can surely boost its gross domestic product by up to 5 percent in the coming years through the NewSpace and related industries of the low-altitude economy,” says Mahesh Harilela, family council convenor of the Harilela Group — one of the first advocates of the NewSpace economy in the HKSAR.

Harilela’s GDP estimate is based on a NewSpace policy proposed by a group of pioneers, including Parker and him, as well as some newly established organizations for the NewSpace economy, such as the Orion Astropreneur Space Academy (OASA) and the AeroSpace Charitable Foundation.

According to Parker and Harilela, their plan takes a leaf from Luxembourg, which has a NewSpace economy similar to the HKSAR’s in several respects, and has successfully commercialized space by focusing on the financial and service sectors since 2016.

In a forecast for the space industry, the World Economic Forum, in partnership with McKinsey & Co, predicts that the space economy “will go from niche to ubiquitous” and grow from $630 billion in 2023 to $1.8 trillion by 2035 in an “increasingly connected and mobile world”.

The Harilela family is one of Hong Kong’s most successful business families with rags-to-riches legends dating back to the city’s formative years in the 1920s. The ethnic-Indian family, which runs businesses in the hospitality and real estate industries, identifies itself as a “patriotic family” of the HKSAR, seeing the city’s growth is closely tied to China’s 14th Five-Year Plan (2021-25), which highlights the space industry as a “national strategy”, while also positioning itself to align with potential priorities in the nation’s future development plans.

READ MORE: Stakeholders push for space industry office in Hong Kong

In January 2022, the State Council’s Information Office issued a white paper titled “China’s Space Program: A 2021 Perspective”, emphasizing the advancement of space governance and space commercial activities.

Technological advancement and emerging opportunities, coupled with government policy support and lower production costs of space hardware, mean that more private enterprises are investing in and producing space hardware and software, says Executive Council convenor and lawmaker Regina Ip Lau Suk-yee.

She says that the local private sector and the nation’s heavyweight players in investment, professionals and the academic community are enthusiastic about the NewSpace economy.

Yu Hongyu, who heads the Hong Kong Space Robotics and Energy Centre, agrees that the central government backing the HKSAR’s push into space-related areas is the result of a deliberate, strategic policy.

“In terms of space research, Hong Kong’s academic strength isn’t as strong as that of universities on the Chinese mainland,” he says. “But, the city’s ecosystem and its entrenched bonds with the world make it an ideal place for further expansion (of the mainland enterprises).”

Parker agrees. “We can and must exploit the State’s support to the maximum extent.”

In addition to academia, Hong Kong’s business circle is aware of the changing tide. The Harilela family believes that Asian family offices must “redefine capital’s role in innovation economy by meaningfully participating in tomorrow’s most disruptive sectors”.

Bill Condon, an international partner and member of the Global Advisory Board at MilleniumAssociates AG, would like to see Hong Kong join forces with its sister cities in the Guangdong-Hong Kong-Macao Greater Bay Area, which is fast emerging as a hub for NewSpace entrepreneurship.

Yu says a cross-boundary ecology of cooperation and coordination among academic institutions and enterprises is taking shape. “The demand for cooperation between the HKSAR and the rest of the Greater Bay Area is growing fast.”

Fostering financial synergies

Harilela goes for the “big picture activity” in line with national polices. “Hong Kong not only focuses on delivering capital to Chinese mainland companies. It also provides them with a springboard to reach outward. Hong Kong can provide the ‘soft utility’ of trust, enabling our nation to achieve further outputs,” he says. “China is strong in the space industry. Why don’t we amplify this facet of financial activities in the HKSAR?”

His appeal for a proactive response to “pluck the low-hanging fruits” in space commercialization is a wake-up call for policymakers, as well as the HKSAR’s service industries.

According to an insider at a mainland space company, some commercial satellite launch projects have gone to London for insurance services instead of Hong Kong.

Robust as Hong Kong’s insurance service industry is, providing professional services for space projects is still a “no-man’s land” in the city.

“Hong Kong holds the ace cards for developing the NewSpace economy,” Parker says. But the city lacks the vision or imagination to look up to space.

“Hong Kong should leverage its existing strengths, such as satellite finance, insurance, legal arbitration, logistics, and data analytics. By attracting private investment and supporting startups, the city could get established firms to relocate their international headquarters,” Condon says.

“However, it seems to me that the government is the missing link,” Parker says. The HKSAR is expected to take the initiative and borrow a playbook from forerunners like Luxembourg and Singapore to “make it happen”.

Ip, who’s also founder and chairwoman of the New People’s Party, visited Luxembourg earlier this year for a glimpse of its NewSpace economy. The European country’s space sector has been playing a pivotal role in accelerating its economy, with projections it would contribute to 5 percent of GDP.

She suggests the HKSAR should set up an “all-inclusive, one-stop office to cope with the ever increasing demand for cross-boundary coordination and cooperation”.

Chief Executive John Lee Ka-chiu’s fourth Policy Address focuses on talent and funding for the research and application of space technology, leaving the commercialization of space, as well as the professional services, legal disputes and space governance, inadequately addressed.

Earlier this year, Bernard Chan Pak-li, undersecretary for commerce and economic development, said the HKSAR government had “consistently supported research and development across various technological fields through the Innovation and Technology Fund”, but left the professional services of the finance, insurance, and mediation sectors untouched.

Gregg Li, who founded the OASA which aims to nurture future technopreneurs, says, “Pure science isn’t Hong Kong’s strength. For the city, tapping the NewSpace economy is all about commerce.

“We need to build business in this aspect by providing commercial solutions — that’s Hong Kong.”

Ip says Hong Kong legislation empowers the chief executive to grant licenses for the launch of space objects, although it’s something that’s unlikely to happen in the HKSAR anytime soon.

ALSO READ: Seminar explores HK’s potential in space-related technology industries

“We’re talking about Hong Kong’s soft capacity — professionalism in financial, insurance, legal and governance,” Harilela says. “Hong Kong is a universal adapter in that the city can play its role in space governance.”

Ip calls for Hong Kong to play a part in formulating international rules. “We’re a very strong, robust common law jurisdiction. A lot of updating needs to be done about space governance and sustainability. In addition, we can certainly help provide mediation and arbitration services,” she says.

For stakeholders, especially entrepreneurs, any decision by Hong Kong to take off to space is “straightforward”, Condon says.

“For the Hong Kong of tomorrow, the only question is: How high would it dare to go?”

Contact the writer at jessicachen@chinadailyhk.com