HSBC Holdings Plc has taken the unusual step of getting directly involved in pushing its Hong Kong subsidiary, Hang Seng Bank Ltd, to offload portfolios of bad real estate debt.

About two months ago, the lender directed its London-based global chief corporate credit officer and the head of its special credit unit to ensure Hang Seng started a process of selling portfolios, according to people familiar with the matter, who asked not to be named discussing private deliberations.

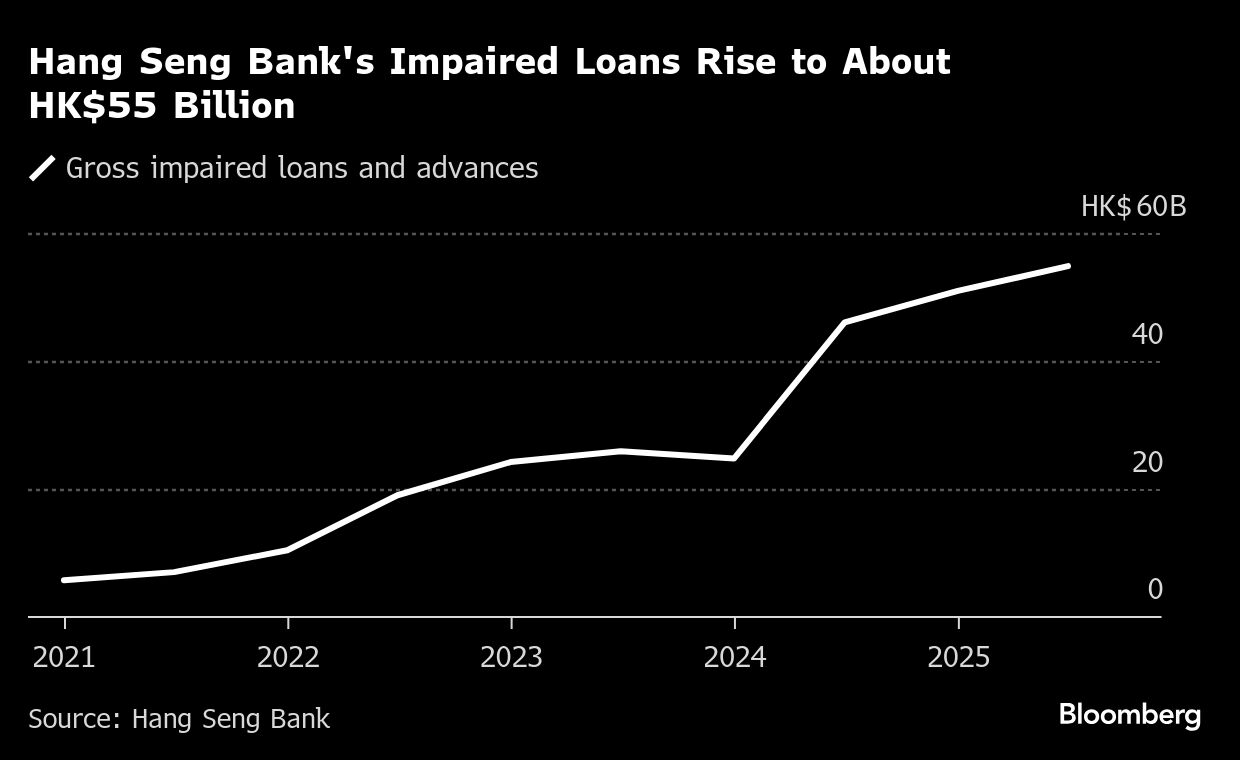

The push is showing results, with Hang Seng Bank now in the early stages of selling a series of property-backed loan portfolios worth more than $3 billion, the people said. The move came after Hang Seng saw an 85 percent year-on-year jump in Hong Kong real estate loans.

There have even been discussions in the sector of creating a “bad bank” to take over the soured loans, which Fitch Ratings estimates at about $25 billion, based on Hong Kong Monetary Authority data.

Hang Seng Bank, which is about 63 percent owned by HSBC, had impaired loans to Hong Kong commercial real estate of HK$25 billion ($3.2 billion) as of June.

“All banks constantly look to optimize their credit portfolio, manage their risks, and take decisions that carefully consider the impacts on their customers,” an HSBC spokesperson said in a statement. “Hang Seng takes its own decisions under its own governance.”

A spokesperson for Hang Seng said the lender had no comment on Bloomberg’s reporting, adding that the “bank manages credit risks of our loan portfolios according to international regulations and accounting standards, including timely and appropriate loan classification and provisioning as well as loan recovery and disposal.”

HSBC has also recently reshuffled the top leadership at Hang Seng, shifting out Chief Executive Officer Diana Cesar for Luanne Lim, who was HSBC’s head of Hong Kong.

The Hong Kong and International Chapter of the China Real Estate Chamber of Commerce this month proposed that the government set up a HK$20 billion fund to invest in properties to help prevent systemic financial risks.

Without a clear strategy to handle non-performing loans, Hong Kong banks have often relied on their own individual relationships with private lenders and other key institutional relationships to help them buy assets on an individual basis.

By involving top bankers in London, HSBC wanted to ensure a speedier disposal, the people said.

Under HSBC’s new oversight, it’s aiming for a holistic approach rather than piecemeal attempts. To meet these requirements, the Hong Kong lender has reached out to consultants to help it orchestrate the sale.

Hang Seng is looking to offload two portfolios backed by real estate assets from Hong Kong developers, including Emperor International Holdings Ltd and Tai Hung Fai Enterprise Co, the people said.

ALSO READ: HK property market embraces diversity

All of these deals are at an early stage and subject to change, the people said. Bloomberg News earlier reported that Hang Seng was looking to sell one of these portfolios.

In the wake of the crisis in the late 1990s, the HKMA implemented three main directives aimed at preventing an NPL build-up, including enhanced supervision of banks and greater credit oversight to help ensure banks made sound decisions when allocating capital.

Yet, none of these directives provided a clear blueprint on how to manage bad debt. Additionally, the Hong Kong senior bankers in charge of past clean-ups have nearly all left the industry, leaving an institutional knowledge gap.

Still, it’s an open question as to how well HSBC’s directive will be followed. Hang Seng and consultant firms have reached out to a couple of private credit firms, with neither party providing clear instructions on the next steps to acquire the loans, said some of the people.