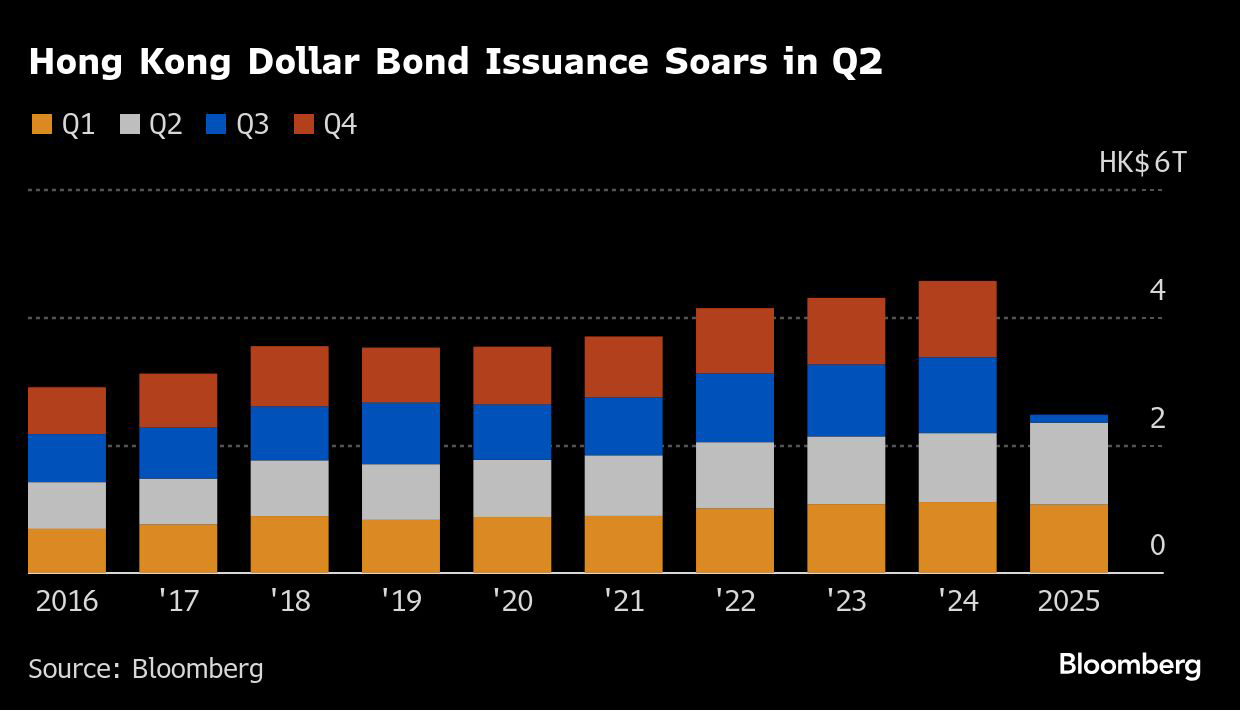

Bond sales in Hong Kong dollars surged in the second quarter as issuers rushed to raise funds after currency interventions in the city drove down short-term borrowing costs to nearly zero.

Hong Kong dollar bond issuance jumped to a record HK$1.28 trillion ($163 billion) in the April to June period, according to Bloomberg data going back to 1988. The bond sales were up about 20 percent from the previous quarter.

ALSO READ: HKMA defends Hong Kong dollar peg for fourth time in two weeks

The Hong Kong Monetary Authority flooded the market with cash in May to cool the local currency’s rally, a move that dragged down the one month borrowing rate to as low as 0.5 percent. While the rate has inched up, with the HKMA now withdrawing cash to stem the currency’s losses, it’s still down from around 4 percent seen in April, offering a respite to borrowers in an economy facing higher US tariffs.

“This is a rare chance and a window for those who want to raise funding,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd in Hong Kong.

“As the Hong Kong dollar has a lower cost of funding, that will be supportive to the local economy, in principle,” he said, adding that the local economy would still need a boost from the Chinese mainland’s recovery.

ALSO READ: Hong Kong bank borrowing rise may signal tighter liquidity

The HKMA typically tracks interest-rate decisions by the US central bank as it maintains a peg against the dollar. The city’s monetary authority has kept its key rate unchanged so far this year and the outlook for further rate cuts is clouded as investors wait to see the impact of tariffs on US inflation and monetary policy.

That’s prompting issuers to make the most of the lower borrowing costs in the Hong Kong Special Administrative Region, with corporate loans denominated in the local currency rising around 13 percent to HK$237.8 billion this year, the highest since 2022.

READ MORE: Hong Kong steps up defense of FX peg as fixed range tested again

In the bond market, the Hong Kong SAR government led issuance but a HK$12 billion exchangeable bond offering from Alibaba Group Holding Ltd was notable.

“I expect future issuance quantum to remain robust, as Hong Kong SAR government and agencies access the domestic Hong dollar bond market to fund infrastructure initiatives, while international issuers continue to increase exposure in the space,” said Terrence Pang, a portfolio manager at Fidelity International.