Following exit of Amazon's Kindle, domestic brands were quick to fill void

China's e-paper industry is emerging as a key innovation hub and manufacturing powerhouse, with domestic brands filling the post-Kindle vacuum and driving new growth in digital reading and productivity devices.

"With concerted efforts of manufacturers and supply chain players, domestic companies are fast taking center stage in global competition," said Dong Min, secretary-general of the China Video Industry Association.

Dong said that following the exit of Amazon's Kindle from the Chinese market, domestic brands were quick to fill the void. "Homegrown e-paper readers and digital notepads have rapidly risen to become the primary application formats for e-paper display technology," he said.

READ MORE: Chinese companies steal limelight at display expo

With declining market performance, Kindle announced the shutdown of its Chinese e-bookstore in June 2023.

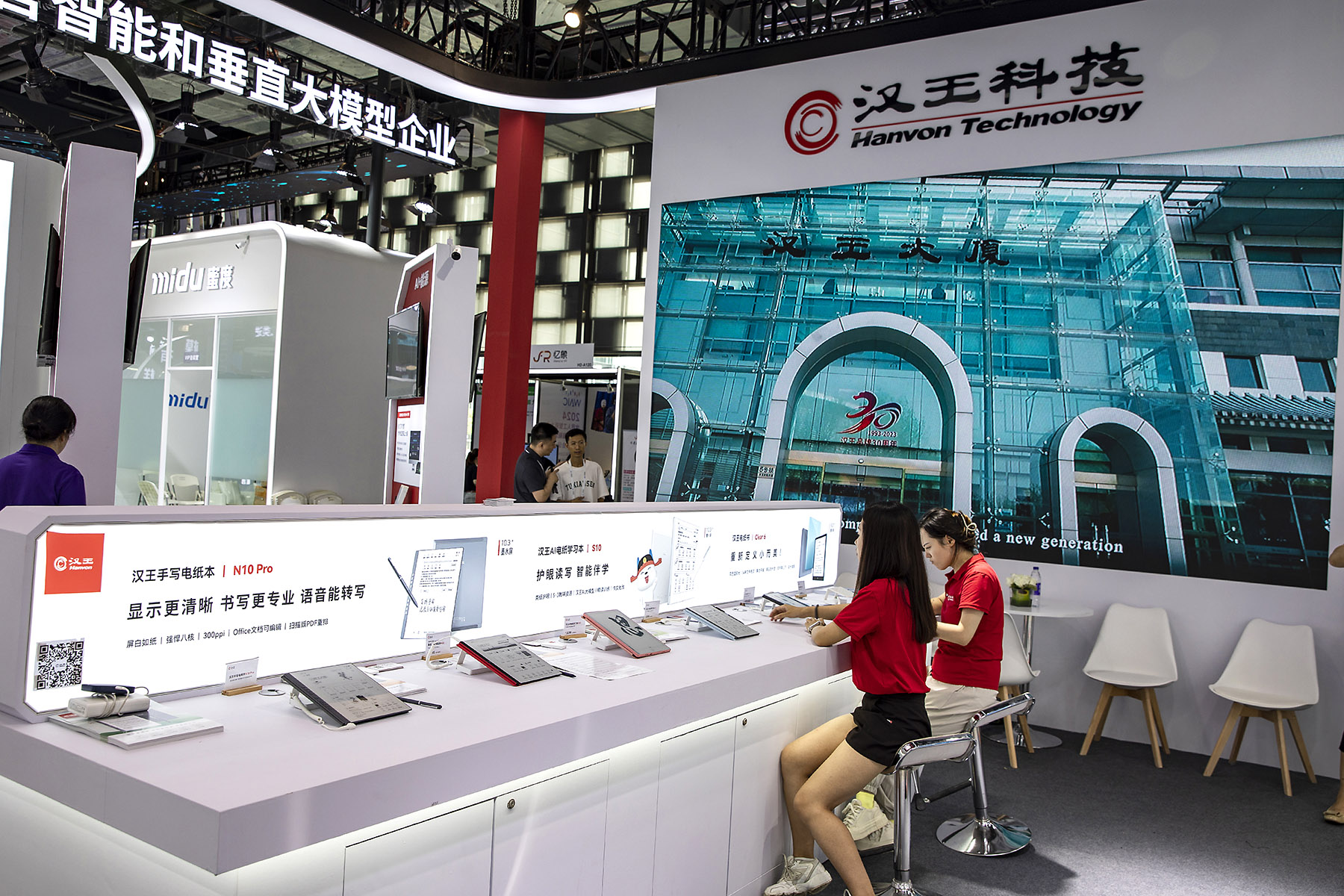

"The withdrawal of Kindle had a big impact," said Liu Yingjian, chairman of major electronics company Hanvon. While Kindle and other global brands doubled down on overseas markets, Chinese companies turned their focus inward, intensifying competition in product specs, ecosystems and technology, Liu added.

The reshuffle proved fruitful for Chinese firms. Data from market consultancy Runto Technology showed that after 2023, domestic brands picked up growth momentum, hitting a 7.7 percent rebound in 2024. Specifically, total tablet e-paper sales in China across all channels reached 1.83 million units last year, up 49.1 percent year-on-year.

"We've seen brands flourishing. One exited and many more rose in its place," Liu said.

"Chinese e-paper manufacturers have shown a better grasp of domestic consumer needs and they know how to turn user demand into real product features," said Li Yang, head of electronic education devices at major retailer platform JD.com.

Li noted that e-paper products on the platform have seen a compound annual growth rate of over 40 percent in the past four years, with domestic brands growing particularly fast.

A recent industry report by Runto Technology showed that the global e-paper display market was expected to surpass $14.2 billion in 2024, up 29 percent year-on-year, putting it among the leading next-generation display technologies. In China alone, e-paper tablet shipments are projected to hit 3.1 million units by the end of 2025, growing more than 30 percent and far outpacing the global average of 9.3 percent.

Wang Jie, vice-president of Hanvon, believes that e-paper devices will become the third major smart terminal after phones and PCs, especially in sectors like education and office work.

"With low power consumption, eye protection and an extremely paper-like reading and writing experience, e-paper is better suited for light productivity tasks than traditional tablets," Wang said.

Industry experts see this surge in demand as part of a larger shift toward display innovation. Li Yongjian, a professor at the University of the Chinese Academy of Social Sciences, pointed out that the push for domestic innovation in display materials is fueling a new generation of digital infrastructure and application ecosystems.

"Color displays are definitely becoming a key frontier for the e-paper industry," said Liu Senhua, general manager of e-paper display technology firm E Ink's China unit, adding that currently color e-paper remains a technical challenge due to high material costs and immature ecosystems. Still, the company invests 10 percent of its annual revenue in R&D to push new technology forward, Liu said.

ALSO READ: Tech firms ramp up efforts in e-ink displays

In other fields of e-paper tech, Chinese companies are also pushing the envelope in core technology. At this year's Consumer Electronics Show in January, Hanvon unveiled the world's first dual-mode EMC-touch chip HW0888, which supports both passive electromagnetic pens and capacitive touch, alongside new innovations in digital signatures and handwriting OCR.

Looking ahead, Hanvon said it plans to strengthen ecosystem integration by partnering with e-book platforms like JD.com, Dangdang and China Literature, to refine the digital reading experience for users.

The rise of digital reading is fueling demand in the e-paper market. According to the China Audio-video and Digital Publishing Association, the domestic digital reading market reached 66 billion yuan ($9.21 billion) in 2024, accounting for half of the overall publishing industry, with 670 million users and a library of over 63 million digital titles.

Contact the writer at lijiaying@chinadaily.com.cn