Hong Kong Monetary Authority (HKMA) Chief Executive Eddie Yue Wai-man said on Tuesday that he expected a short-term drop in the Hong Kong dollar interest rate, due to ample liquidity in the city’s banking system, to help in reducing loan repayment pressure on businesses and mortgage loan borrowers.

The HKMA on Tuesday said it bought HK$60.5 billion ($7.75 billion), the largest single-day capital injection up-to-date, against the Hong Kong dollar to stop the local currency from strengthening and breaking its peg to the US dollar.

Since last Friday, the HKMA had intervened the currency market with a total injection of about HK$127.8 billion. The aggregate balance, the key gauge of cash in the banking system, will increase to HK$174.1 billion on Thursday. As funds become more abundant, the Hong Kong dollar’s interbank rate may fall.

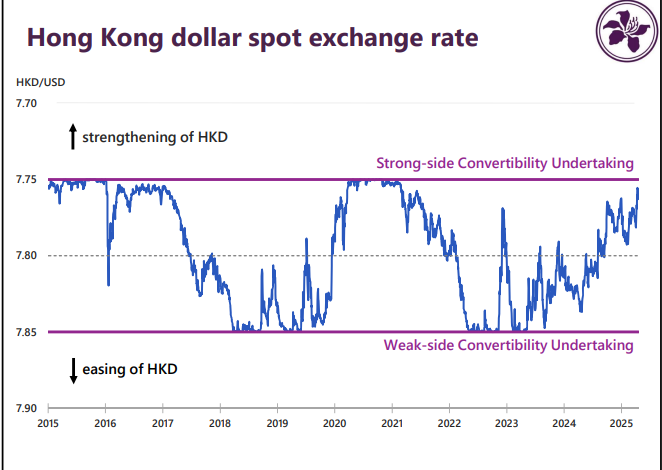

Asia-Pacific currencies have risen sharply against the US dollar recently amid market speculation that US trading partners are pushing foreign currency appreciation ahead of sealing trade negotiation deals with the world’s largest economy. The Hong Kong dollar exchange rate has hit the strong side convertibility band level for several consecutive trading days, reflecting the continued inflow of southbound funds into the stock market and position-closing activities of other Asian-Pacific currencies in recent days.

READ MORE: Hong Kong buys record amount of US dollars to defend peg

“The subsequent development of the Hong Kong dollar interest rate will depend on the stock market demand (fund-raising activities) and corporate demand (dividend payment) for the Hong Kong dollar, as well as the trend of US interest rates. If the US interest rate is higher than the Hong Kong interest rate, carry trading may occur in the market, which may cause the Hong Kong dollar to weaken. The impact on the total balance of the banking system needs to be further observed,” Yue told a meeting of the Legislative Council’s Panel on Financial Affairs.

According to HKMA data, it had intervened in the Hong Kong currency 85 times in 2020, attempted to trigger the strong-side convertibility band level 47 times in just two months, injecting more than HK$383.5 billion throughout the year, and the aggregate balance rose sharply to nearly HK$460 billion at the end of the year.

“The macro prudential parameters behind Hong Kong’s Linked Exchange Rate System remains strong, and the banking system remains healthy. A fiscal surplus is not a prerequisite for operating the LERS as a monetary system. Even though a budget deficit has dragged down foreign exchange reserves, the impact of deficit can be managed,” said William Deng, UBS Investment Bank’s senior Asia and China economist.

Oriol Caudevilla, board director and secretary-general of the Global Impact Fintech Forum, believes it would be wise for Hong Kong to keep its currency peg to the greenback despite the ongoing trade war.

“The currency peg allows predictability in trade, investment, and capital movements, whereas an open, rule-based monetary anchor is more valuable than discretionary flexibility in monetary policy autonomy,” he said. “The HKMA still has the capacity to defend the linked exchange rate system, and there’s a clear political will to defend the exchange rate.”

The Hong Kong dollar has been pegged to the US dollar under the LERS since 1983 to ensure exchange rate stability and promote investor confidence. The peg ties the Hong Kong dollar at approximately 7.80 per US dollar, with a permitted trading range of 7.75 to 7.85.

Meanwhile, the HKMA has given details of the performance of the Exchange Fund -- the war chest that defends the local currency.

Excluding other investments, the fund posted an investment income of HK$67.2 billion in the first quarter of this year -- up 7.8 percent on a yearly basis. It turned from a loss to a profit on a quarterly basis as this item recorded a loss of HK$20.3 billion in the fourth quarter of last year.

READ MORE: City needs proactive strategy to allow it full financial flexibility

Investment income in the period mainly came from bonds, reaching HK$40.6 billion -- up nearly 62 percent year-on-year and 2.5 times quarter-on-quarter. Investment income from Hong Kong equities stood at HK$16.4 billion, turning losses into profits both yearly and quarterly. Foreign exchange gains reached HK$13 billion, also turning losses into profits on both an annual and quarterly basis. Foreign equities lost HK$2.8 billion, turning profits into losses both on annual and quarterly basis.

The Hang Seng Index rose 158 points, or 0.7 percent, on Tuesday to close at 22,662 points on a market turnover of HK$213.3 billion.

The Hang Seng China Enterprise Index -- the barometer of mainland-based company performance – picked up 0.4 percent to finish at 8,261 points, while the Hang Seng Tech Index -- the city’s technology stock gauge -- fell 0.1 percent to close at 5,239 points.