This undated photo shows a view of Hong Kong as seen from Victoria Peak. (PAUL YEUNG / BLOOMBERG)

This undated photo shows a view of Hong Kong as seen from Victoria Peak. (PAUL YEUNG / BLOOMBERG)

They’ve mapped out exit routes, opened offshore bank accounts and secured overseas passports.

But for now at least, Hong Kong’s high-net-worth investors are mostly staying put, easing fears that the city’s latest political situation would unleash a flood of capital outflows.

Withdrawals have been minimal since the National Security Law came into effect on June 30 and the city’s officials have repeatedly said that the law would not affect the normal operations of financial markets and legitimate business of financial institutions and market participants in the city.

While critics of the legislation have argued it will undermine Hong Kong’s role as a financial center, some wealthy investors are open to an alternate narrative -- espoused by Hong Kong’s government and the city’s richest tycoons -- that the law will help stabilize an economy battered by months of anti-government protests stemming from the extradition bill incident.

ALSO READ: Global investors speak positively of security law, HK official says

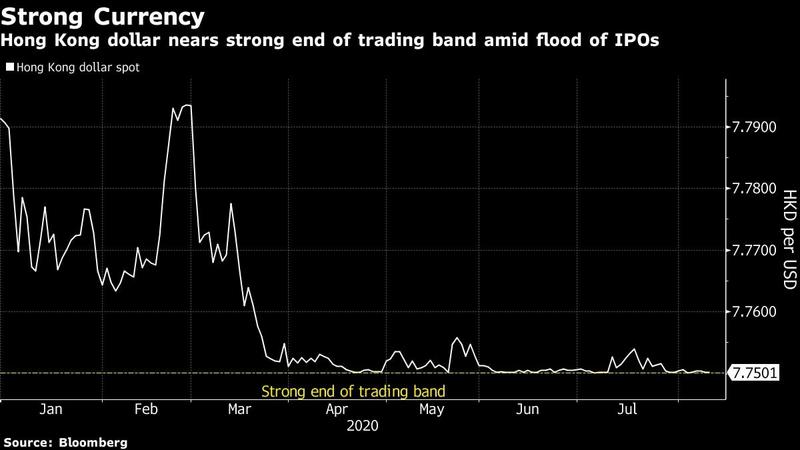

Whether the sanguine outlook will last is anyone’s guess, especially with the special administrative region caught in the crossfire of an intensifying clash between China and the US. But the upshot since June has been a strong Hong Kong currency, a resilient property market and steady stock prices. Capital inflows have been so big in recent weeks that authorities intervened to prevent the local currency from breaching the strong end of its trading band.

“While people are probably opening overseas accounts and considering leaving, their preparation won’t lead to a major exodus of capital yet,” said Kenny Wen, a Hong Kong-based wealth management strategist at Everbright Sun Hung Kai Co. “Money is moving into Hong Kong at the same time because investors are bullish on Hong Kong’s stock market, especially the new listings.”

READ MORE: Hong Kong sees capital inflows worth US$14b since April

Inflows into the city’s stocks through mainland exchange links more than doubled from a year earlier to US$16.6 billion since early June

Inflows into the city’s stocks through mainland exchange links more than doubled from a year earlier to US$16.6 billion since early June. Meanwhile, regulators in June kicked off a long-anticipated program called Wealth Management Connect, which is set to further boost inflows by allowing residents in southern China to invest in the SAR and vice-versa.

“We can foresee even more business opportunities and greater growth headroom for Hong Kong’s financial industry,” Eddie Yue, chief executive of the Hong Kong Monetary Authority, said last month. “As we all know, a safe and stable social environment is what every investor looks for and finds comfort in.”

For now, wealthy individuals who want exposure to China’s budding economic recovery see little reason to ditch Hong Kong. The city is still an unrivaled hub for buying everything from mainland shares and dollar bonds to financial derivatives. And with the Chinese mainland now ahead of many nations in getting back on its feet from the pandemic, many are loath to leave money on the table.

“If you’re bullish on China, it’s hard to justify why you would want to pull your money out,” said Benjamin Quinlan, chief executive officer of Quinlan & Associates, a consultancy in Hong Kong.