Shares of Montage Technology Co jumped 64 percent in their Hong Kong debut on Monday after a share sale that raised $902 million, the biggest opening-day pop for an offering of its size or bigger in five years, showing persistent demand for Chinese mainland artificial intelligence-related stocks.

The chip designer’s stock closed HK$175 after a share sale that was priced at HK$106.89, the top of the offered range. The company sold 65.9 million shares at that price on Thursday, a 44 percent discount to the Shanghai-listed stock that closed at 170.90 yuan the previous day.

Montage recorded the biggest jump at the open among Hong Kong listings that raised more than $900 million since Kuaishou Technology’s $6.2 billion initial public offering in 2021. Its performance shows the resilience of investor appetite for mainland AI-related stocks after record initial pops last year.

ALSO READ: Chip designer Montage is said set to price $902m Hong Kong listing at top

The Shanghai-based company is joining a wave of mainland artificial intelligence firms tapping the market, including January debuts by GigaDevice Semiconductor Inc and OmniVision Integrated Circuits Group Inc.

“Investor enthusiasm for AI-related companies remains strong,” said Bosco Wu, a strategist at the Bank of East Asia. “AI-related firms that went public in January have delivered steady performance, further supporting Montage’s price rally, and China’s policy support also bolster sentiment across the sector.”

GigaDevice has experienced a 93 percent surge in price since debut in Hong Kong in January, while Minimax Group Inc is up 196 percent.

Montage’s debut coincided with a bounceback day for Asian stocks, particularly in the technology sector that’s coming off a major selloff. The Hang Seng Technology Index rose as much as 2.1 percent following a 6.5 percent drop last week.

“We maintain our positive view on Montage as a rare opportunity among China semiconductor names to gain exposure to the global data center expansion,” Citigroup Inc analysts led by Kevin Chen wrote in a note earlier this month, citing their view on Montage’s Shanghai-listed shares.

READ MORE: Chinese chip designer Montage seeks up to $902m in HK listing

Montage designs chips that help speed data flows within data centers and AI accelerators. It was the largest global memory interconnect chip supplier in 2024, with more than one third of market share by revenue, according to a listing document filed with the Hong Kong stock exchange, citing US consultancy Frost & Sullivan.

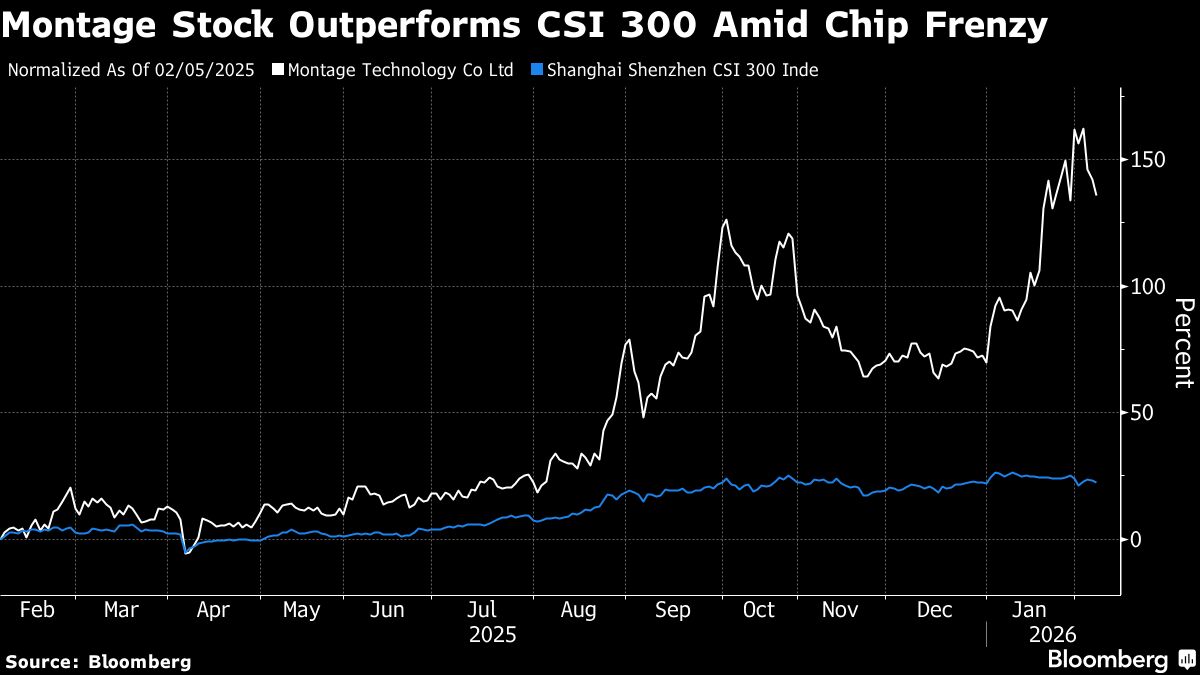

The company’s shares have more than doubled over the past year in Shanghai, giving it a valuation of about $29 billion. Montage recently reported net income of 2.15 billion yuan to 2.35 billion yuan for 2025. The metric could rise to 3.3 billion yuan in 2026, according to analysts polled by Bloomberg.

China International Capital Corp, Morgan Stanley and UBS Group AG are joint sponsors of Montage’s listing.