Chery Automobile Co, the Chinese mainland’s biggest car exporter, rose in its Hong Kong Special Administrative Region trading debut after raising HK$9.1 billion ($1.2 billion) in an initial public offering to help power its overseas expansion ambition.

The shares climbed as much as 14 percent to HK$34.98 on Thursday. It was up 9.3 percent at 10:07 am, giving it a market capitalization of about $25 billion, and making it bigger than Geely Automobile Holdings Ltd but smaller than Great Wall Motor Co in terms of valuation.

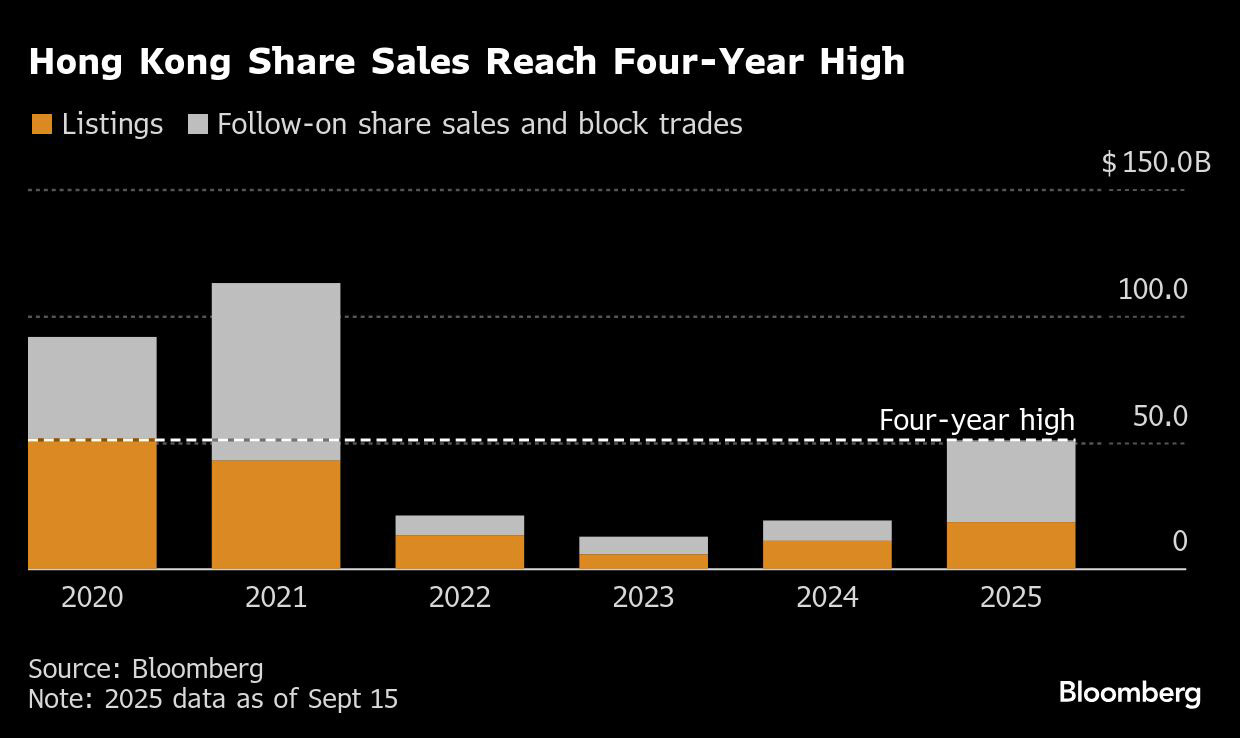

Chery is the latest mainland company to capitalize on Hong Kong’s popularity as a listing destination, where proceeds have soared to a four-year high. More billion-dollar debuts are on the way, with Zijin Gold International Co planning for its shares to start trading next week in the city after a $3.2 billion IPO, the world’s biggest deal of its kind since May.

“There should be demand from investors looking to get exposure to China’s auto exports potential, particularly into emerging markets where Chery has been very successful,” said Eugene Hsiao, head of China equity strategy at Macquarie Capital.

A gauge tracking global automaking stocks has gained 12 percent this year, with mainland shares leading the gains.

Chery, which assembles Jaguars and Land Rovers in the mainland, said it plans to plow the proceeds toward research and development, overseas expansion and factory upgrades.

Chery delivered 1.14 million vehicles to foreign markets in 2024, or 40 percent of its total. Rivals including BYD Co and Zhejiang Leapmotor Technology Co have also been pushing for sales overseas, where cars tend to fetch higher profit margins than at home.

The automaker has remained the mainland’s top exporting brand every year since 2003, according to Frost & Sullivan. Its lineup has a high proportion of fuel-powered vehicles, with relatively affordable pricing, making them well-suited to emerging markets. Russia, the Middle East and South America are among its top target overseas sales destinations.

ALSO READ: Mainland’s Chery Auto seeks up to $1.2b in HKSAR IPO

In the mainland, the company faces fierce competition as consumers increasingly turn to brands like BYD to drive electric vehicles.

Chery also marks the latest trophy listing for the SAR, where Bloomberg Intelligence forecasts IPO proceeds to surge to more than $26 billion this year.

Though the debut went on as planned, the company scrapped its listing ceremony at the Hong Kong stock exchange after Super Typhoon Ragasa brought the city to a standstill the previous day.

China International Capital Corp, Huatai Securities Co, GF Securities Co and Citic Securities Co were overall coordinators of the IPO.