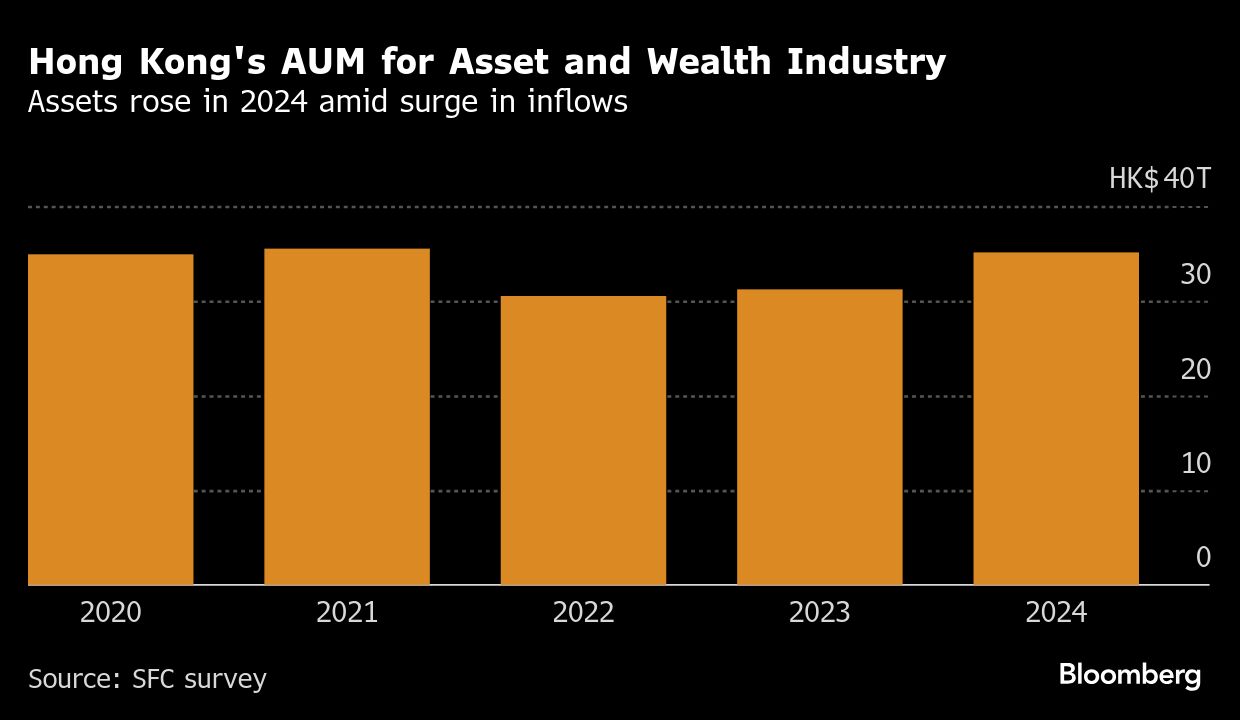

Hong Kong’s assets under management across its asset and wealth management industry rose 13 percent to HK$35.1 trillion ($4.5 trillion) as inflows surged last year, underscoring a recovery in the Asian financial hub.

Net fund inflows jumped 81 percent to HK$705 billion across the industry in 2024, according to a survey conducted by the Securities and Futures Commission. In particular, inflows for the asset management and fund advisory business soared 571 percent to HK$321 billion.

ALSO READ: Hang Seng’s stellar run takes it toward highest level in 3 years

Assets for private banking and wealth rose 15 percent to HK$10.4 trillion, boosted by net inflows of HK$384 billion.

The Hong Kong Special Administrative Region has been stepping up efforts to attract wealthy with tax concessions and residency plans. The city’s equity benchmark is trading near its highest level in over three years, boosted by increased optimism toward technology stocks and strong demand from Chinese mainland investors.

ALSO READ: Chan: HK's assets under management hit HK$31 trillion despite headwinds

“Hong Kong is gaining more clout than ever as a leading international hub for asset and wealth management, propelled by strong fund inflows, financial innovation and a growing talent pool,” said Christina Choi Fung-yee, the SFC’s Executive Director of Investment Products.

Hong Kong-domiciled funds authorized by the SFC recorded net fund inflows of HK$163 billion in 2024, followed by HK$237 billion in the first five months of 2025.

READ MORE: Mega events, CEPA to further boost HK economy

This year, 1,237 firms took part in the SFC’s annual survey, including asset managers, private banks and insurance companies.