Chinese mainland's tech giant Alibaba Group Holding Ltd raised HK$12 billion ($1.5 billion) from the sale of bonds exchangeable into shares of a unit, Alibaba Health Information Technology Ltd.

The bonds, which are due in 2032, will carry a zero coupon and have an initial exchange price of HK$6.23, according to a statement from the company. That represents an exchange premium of 48 percent over the final price of a concurrent placement of Alibaba Health shares to help investors hedge their positions.

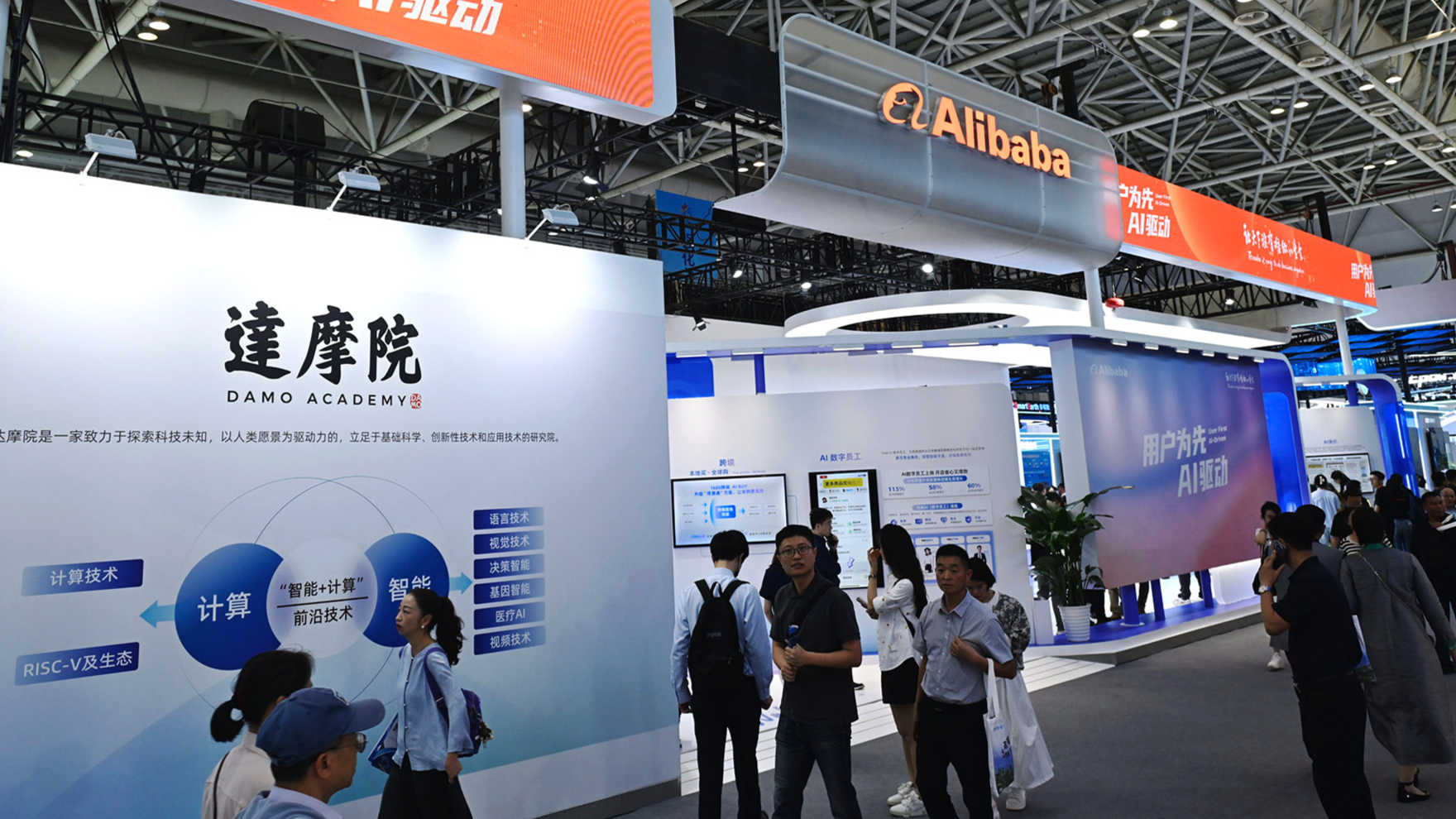

Alibaba plans to use the proceeds from the bonds for investments to support the development of its cloud infrastructure and international commerce business.

Tech companies on the mainland have used exchangeable bonds to pare down stakes previously, such as when Baidu Inc raised $2 billion from the sale of notes exchangeable into Trip.com Group Ltd shares in March.

Equity-linked deals have steadily gained traction in Asia this year, as increased market volatility and high interest rates make these lower-coupon instruments increasingly attractive to issuers.

READ MORE: Alibaba expands AI cloud services in Malaysia, Philippines

JPMorgan Chase & Co, UBS Group AG, Citigroup Inc and Morgan Stanley arranged Alibaba’s exchangeable bond deal.