The Sino-US trade talks have brought a silver lining for world trade. It's time for the US administration to get back on the right track.

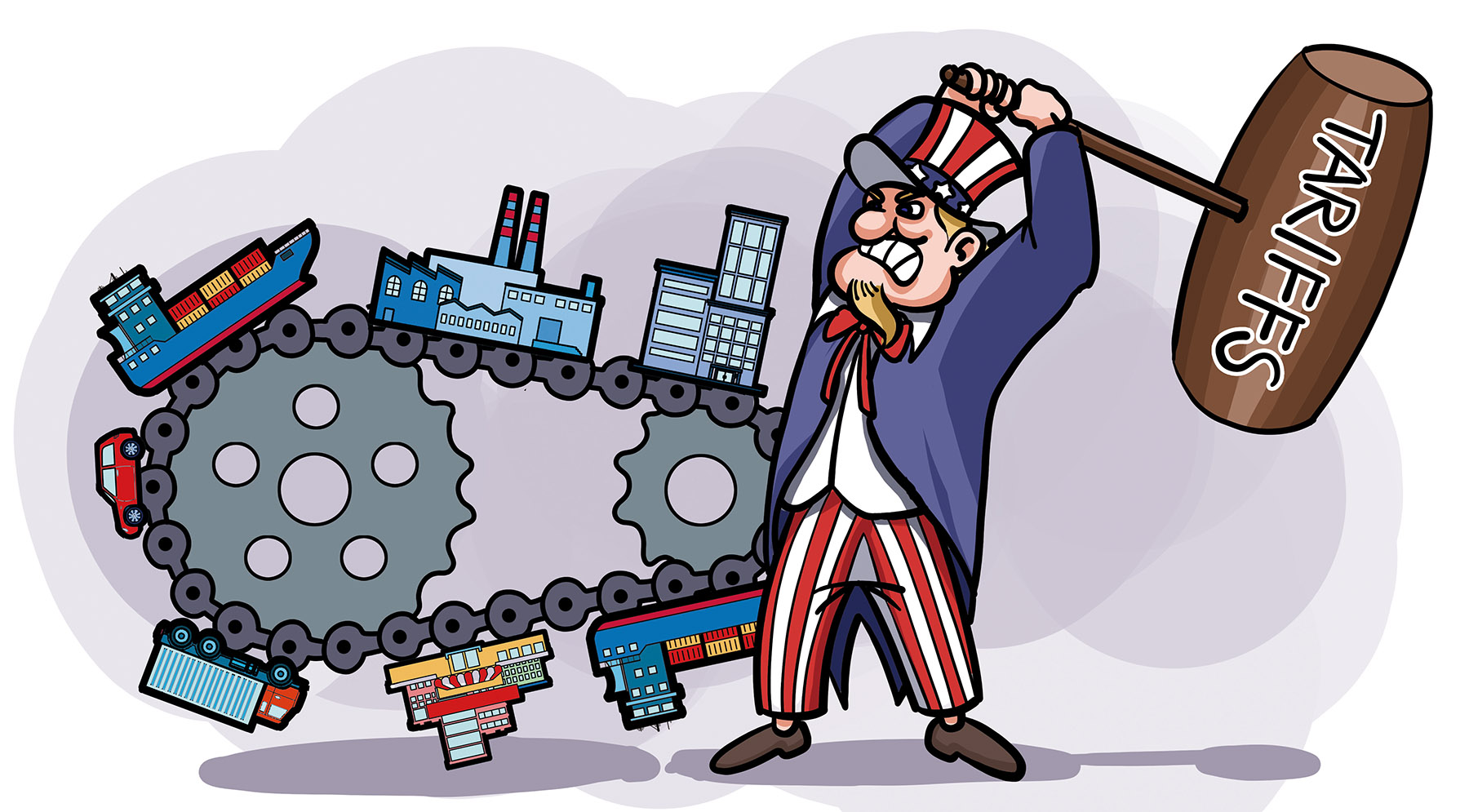

After agreeing to suspend the "reciprocal "duties for 90 days — till early July — the US administration threatened to set country-specific tariff rates. By making good the promise and imposing unilateral tariffs on imports from the US' trading partners, the US administration will severely disrupt export-led growth, which has fueled global growth for years, and shatter the development dreams and aspirations of emerging and developing economies.

China's increasing foreign trade volume proves that global trade has been fueling global growth.

In 2024, US exports amounted to some $2.06 trillion. That's significantly more than those by Germany ($1.7 trillion) and the Netherlands ($725 billion), Europe's two largest trading economies. Yet today the value of US exports is less than 60 percent of those by China, which amount to $3.5 trillion.

READ MORE: China urges US to honor trade agreements

China's exports have some 230 destinations. Most go to major economies in North America (the United States, Mexico and Canada), Western Europe (Germany, the Netherlands, the United Kingdom), East Asia (Japan and the Republic of Korea), Southeast Asia (Vietnam, Malaysia and Thailand), and India, Russia and Australia.

In 2018, before the first Donald Trump administration launched the tariff war, the US still accounted for more than 19 percent of China's exports. In 2024, that figure was less than 15 percent; that is, less than China's exports to Europe or Southeast Asia. After the US launched the tariff war, China has diversified its exports away from the US.

In the past decade, this trend has been greatly reinforced by China's trade with Belt and Road countries. Last year, nearly 54 percent of China's imports came from Belt and Road countries, with the country's huge marketplace providing development opportunities for nations around the world.

China's trade is vital to the emerging and developing economies of the Global South, where the West's exports often are prohibitively expensive. The West exports mainly to economies that share similar high standards of living. Such trade is predicated on high purchasing power, which is the privilege of high-income economies.

The first round of Trump's tariffs built on traditional trade wars were directed mainly at Canada, Mexico and China. The second round began with "reciprocal tariffs", which actually are unilateral, flawed as stated and mistakenly calculated. Those tariffs were followed by a slate of retaliatory tariffs.

The net effect has been a stunning downgrading of the economic prospects of the US, its trading partners and the global economy. What is less understood is the likely long-term effect of the US' unilateral tariffs, which is to undermine the rise of the Global South.

The US administration's original list of these tariff targets comprised almost 60 countries and regions. Except for the European Union as a bloc and a few high-income countries, three of four of these targets represent emerging and developing economies; that is, the Global South. The US administration is curbing their economic development.

Since the late 20th century, most economies that have been able to industrialize and catch-up with the advanced economies of the West have done so on the back of export-led growth. Export is what fueled the rise of the "Asian tigers" in the postwar era (China's Hong Kong and Taiwan, Singapore, the ROK), and their subsequent successors (Malaysia, Thailand, Vietnam and Indonesia).

They were followed by Chinese mainland — and today India and some Southeast Asian economies.

After the end of World War II, the US dominated half of the world economy. It was the "world's factory", the largest manufacturer and exporter. As the largest creditor, it also held huge leverage over the global economy. This dominance, in turn, was reflected by the mighty US dollar that had a virtual monopoly in international transactions.

All that is history today.

ALSO READ: US needs to have correct perception of the give-and-take of trade talks

Of course, the US is still the single largest economy in the world, but its relative share has shrunk to about one-fourth or one-fifth of the global GDP. It hasn't been the world's largest export manufacturer for decades. Starting in the 1970s, it has suffered from trade deficits, and today it is the world's largest debtor. Concurrently, the share of the US dollar in international transactions has shrunk to less than 60 percent.

In the process, Washington has played itself into a dark corner; it cannot fully decouple from China without major economic turmoil. But thanks to its tariffs, it cannot any longer benefit from China's affordable prices, which has long contributed to keeping inflation low in the US.

Today any major threat to undermine Chinese trade poses a big threat — that is, export plus imports combined — to its trading partners, particularly in the Global South and the world at large.

The author is an internationally recognized strategist of the multipolar world and the founder of Difference Group.

The views don't necessarily reflect those of China Daily.