The robust performance of two major Hong Kong stock listings this week has raised hopes that a small group of elite Chinese companies may start driving a shift to end the city’s historical discount to mainland markets.

The latest addition to the cohort is Jiangsu Hengrui Pharmaceuticals Co, China’s largest drugmaker by market value, which surged as much as 37 percent in its trading debut Friday in the Asian financial hub after raising HK$9.9 billion ($1.3 billion). The company’s H-shares briefly commanded a 0.3 percent premium over its Shanghai-listed A-shares, before reverting to a discount of 3.2 percent.

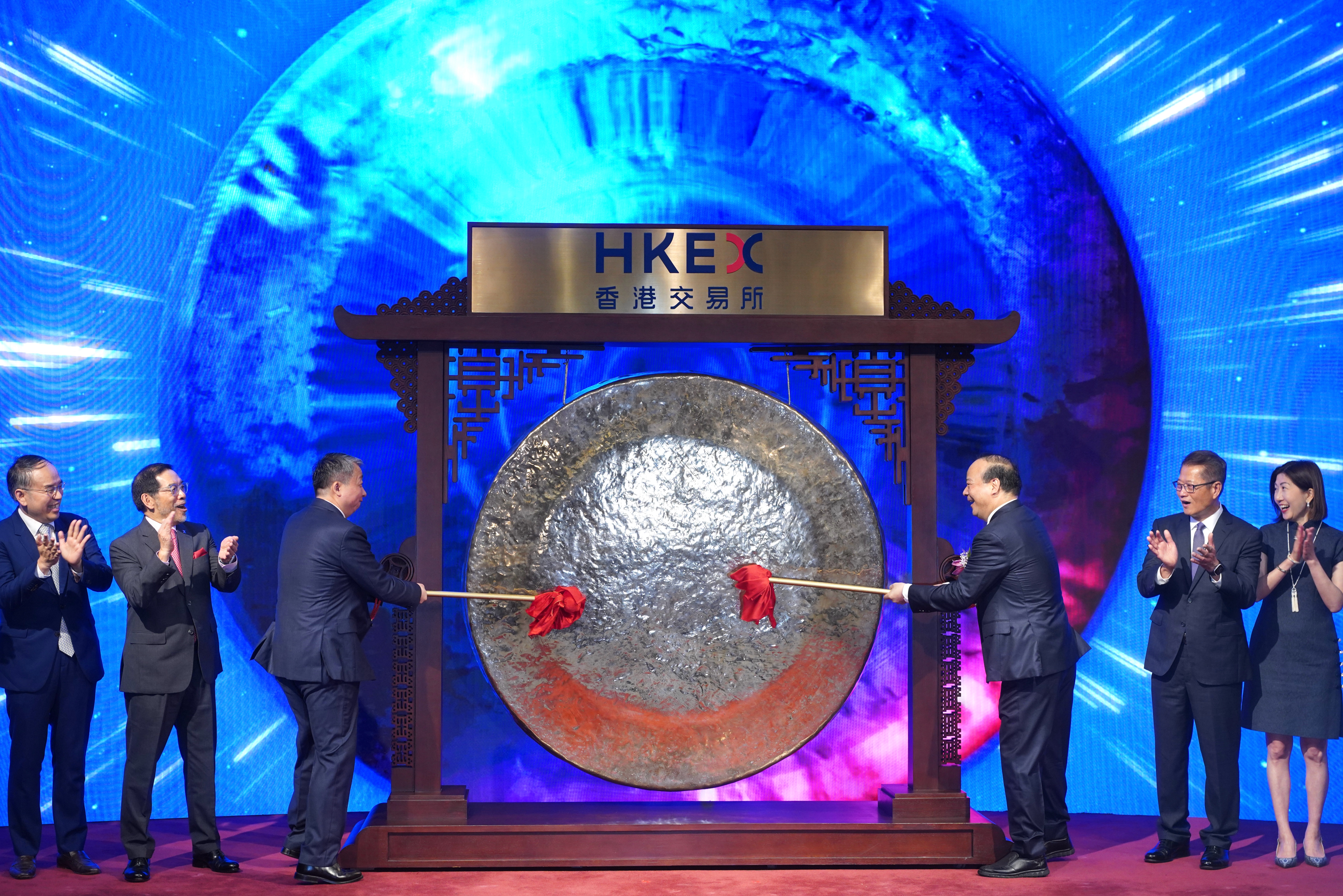

This comes after battery giant Contemporary Amperex Technology Co’s $5.2 billion’s initial public offering in the city, the world’s biggest listing this year. Its shares have soared 22 percent since its Tuesday debut and are around 10 percent pricier than its Shenzhen-listed stock.

ALSO READ: Hengrui Pharma prices at top end for $1.3 billion Hong Kong listing

Among the nearly 150 firms that have listings in both Hong Kong and mainland China, currently only CATL, BYD Co, and China Merchants Bank Co are trading at a premium in Hong Kong, according to Bloomberg-compiled data.

The strong showing of CATL and Hengrui comes on the back of a broader revival of Chinese equities in recent weeks, buoyed a trade truce between the US and China and fresh steps taken by Beijing to spur economic growth. Their stellar listing debuts are rekindling hopes that a small but growing number of Chinese firms with global ambitions may attract enough demand to defy the longstanding valuation gap.

Many Chinese firms that are globally competitive are increasingly being recognized for their worth, meaning companies like CATL won’t see an H-share discount, but an A-share one,” said Zhai Jingyong, managing director at Banyan Investment Management Co.

READ MORE: CATL’s Hong Kong listing proceeds rise to $5.2 billion after greenshoe

To be sure, A-shares as a whole still trade at a premium of 32 percent to H-shares, compared with a low of 28 percent in March, according to the Hang Seng Stock Connect China AH Premium Index. Among the dual-listed stocks, 42 names carry a discount of 50 percent or more in Hong Kong, Bloomberg-compiled data show.

“While some of the gains in CATL and Hengrui may be due to a relatively small float in Hong Kong, there is potential to attract even more foreign capital as they get included in the HSI and MSCI gauges,” said Alvin Ngan, an analyst at Zhongtai Financial International Ltd. Their performance may spark more demand for coming Hong Kong listings, he added.