Leading electric vehicle battery maker Contemporary Amperex Technology (CATL) made a powerful debut on the Hong Kong Stock Exchange, with shares jumping over 12 percent from their offering price in the world’s biggest IPO of the year.

Shares opened at HK$296 ($37.8) on Tuesday, well above the IPO price of HK$263, in a stock offering raised HK$35.7 billion. This has pushed the company’s market capitalization to HK$1.34 trillion, and promoted Hong Kong to the second-largest IPO market globally.

The stock surged nearly 17 percent by the local noon trading break to HK$307.6 per share.

ALSO READ: Year’s largest listing cements Hong Kong’s IPO hub role

The technology giant headquartered in Ningde, Fujian province, is tapping Hong Kong’s global financial status to power its international expansion ambitions and advance its zero-carbon strategy.

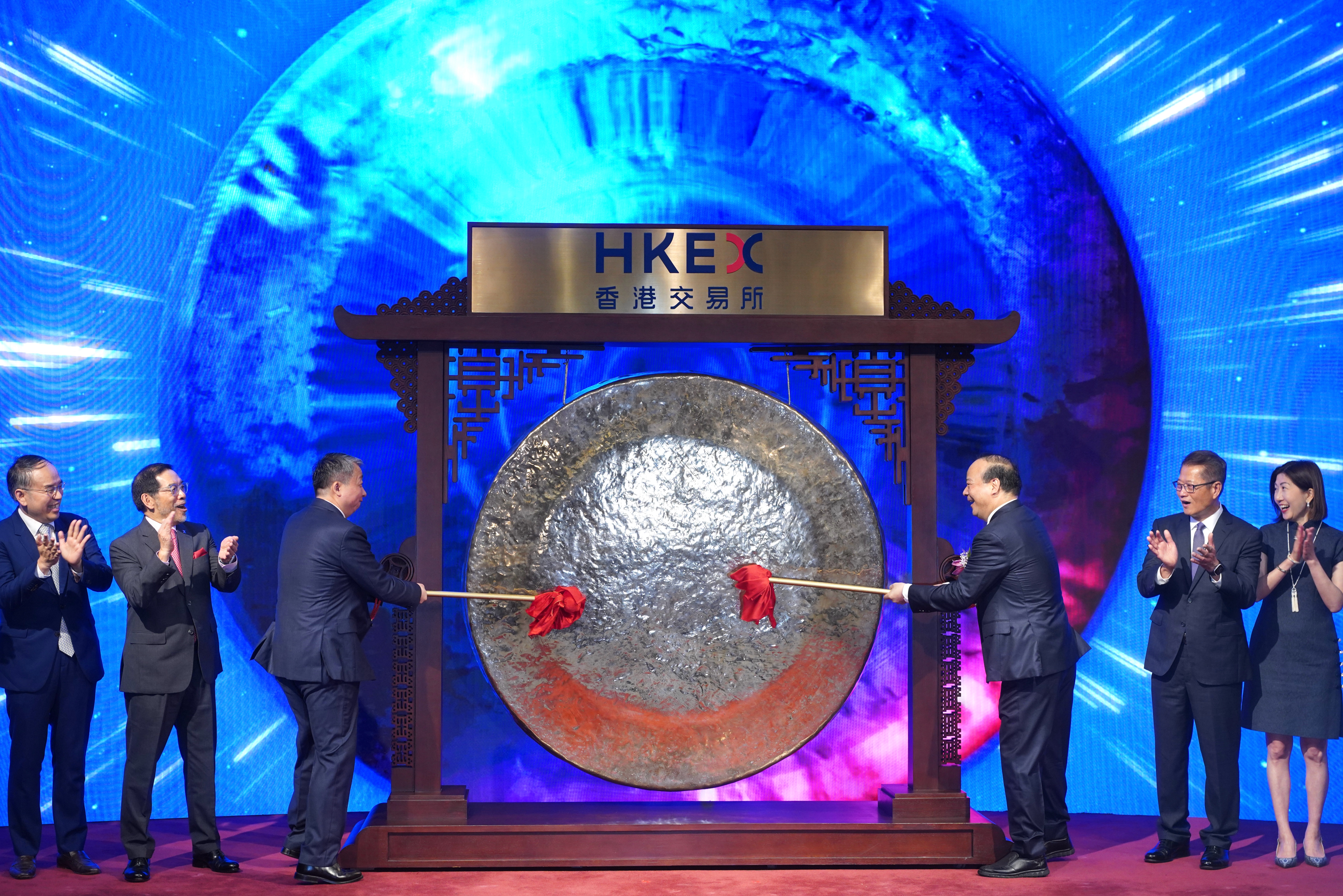

Going public in Hong Kong is a significant milestone for the company, confirming that it has better integrated with international capital markets, CATL Chairman Zeng Yuqun said at the listing ceremony.

The Hong Kong public offering was oversubscribed by more than 150 times, with a 10 percent allocation rate for investors applying for lots of 100 shares. The international tranche was oversubscribed by around 15 percent, reflecting strong investor appetite.

About 90 percent of the proceeds are earmarked for the construction of a new plant in Hungary, as the company already operates six research and development centers and 13 production bases across the globe, serving customers in 64 countries and regions.

Hong Kong Financial Secretary Paul Chan Mo-po described CATL’s successful debut as an example of how Chinese mainland companies are leveraging the Hong Kong Special Administrative Region to accelerate their global strategies.

ALSO READ: EV battery giant CATL begins Hong Kong IPO

He said that this model of raising capital in Hong Kong to support international expansion will increasingly become a major approach for mainland firms going global.

“The listing also reflects growing confidence in Hong Kong’s stock market from both companies and investors,” Chan said, adding that he believes this will inject new liquidity into the market and help optimize its structure.

Bonnie Chan, CEO of bourse operator Hong Kong Exchanges and Clearing Ltd, said among the IPO applications under processing are a growing number of dual-listed companies, like CATL, which has already gone public on the mainland.

She said nearly 100 IPO applications have been received so far this year, with a total of 150 applications now under review. Many of these are industry leaders planning to raise over $1 billion.

Moreover, Zeng said listing in Hong Kong is also a beginning of the company’s journey to lead the global transition to a zero-carbon economy.

READ MORE: CATL's Hong Kong listing approved, sources say it could raise at least $5 billion

He noted that the global zero-carbon transportation market is a trillion-dollar opportunity poised for explosive growth, in light of which CATL is promoting the integration of the transportation and energy grids, in a bid to ensure that the electricity charging EVs is generated in an environmentally friendly fashion.

As a key step, CATL in late 2023 announced the establishment of its global headquarters and R&D center in Hong Kong.

Paul Chan said this has brought together financing, international business management, talent and research capabilities under one roof, which enables the company to capitalize on Hong Kong’s international network and take its business to new heights.

Contact the write at irisli@chinadailyhk.com