Major business chambers in Hong Kong welcomed the joint announcement from China and the United States on trade discussions, boosting Hong Kong’s stock market benchmark 3 percent on Monday.

In a statement responding to China Daily’s inquiry, the American Chamber of Commerce in Hong Kong said it welcomes the announcement of an agreement reached in trade discussions between the US and China in Switzerland.

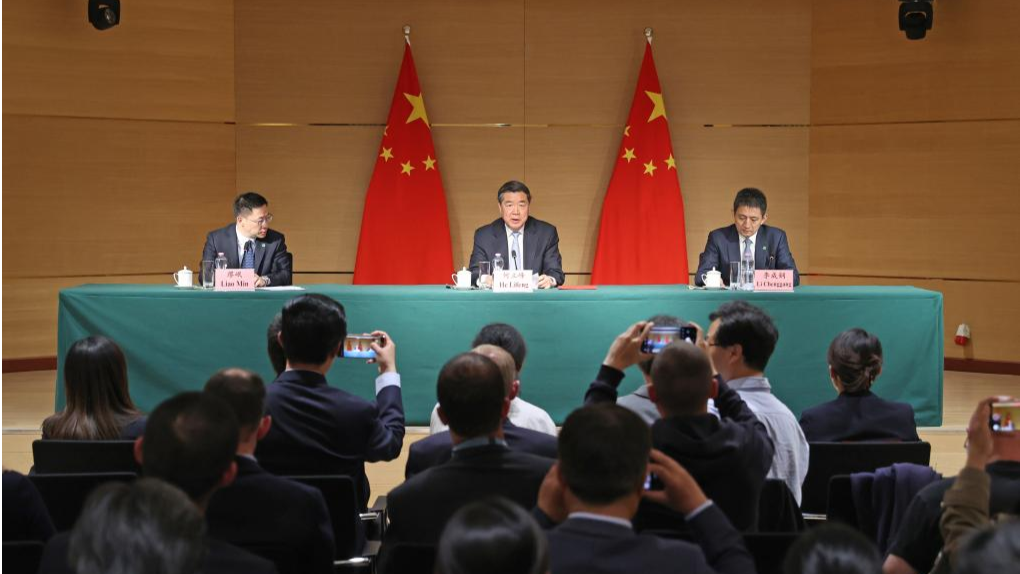

“Our members look forward to good and swift progress and hope that the mechanism for continued discussions about economic and trade relations, led by Chinese Vice-Premier He Lifeng, US Treasury Secretary Scott Bessent, and US Trade Representative Jamieson Greer, will be fruitful and in the interest of both countries,” the statement said.

READ MORE: Mutual respect the foundation for navigating China-US trade talks

According to the announcement, the US suspended the implementation of a 24 percent “reciprocal tariff”, and China also correspondingly suspended the implementation of a 24 percent retaliatory tariff, within the initial 90 days.

The two sides will also cancel the tariffs imposed on each other’s imported goods in their subsequent two administrative orders and tax committee announcements.

In addition, China will suspend or cancel its nontariff countermeasures against the United States as of April 2. All the above measures will be implemented before Wednesday.

The Federation of Hong Kong Industries welcomed the announcement as it marks a constructive first step toward enhancing communication and fostering meaningful dialogue between the two nations, which is an encouraging development for its members.

“We are pleased to see progress in the trade dialogue and reiterate our strong support for open markets, which are fundamental to global economic growth and the success of Hong Kong’s business community,” FHKI Chairman Steve Chuang Tzu-hsiung told China Daily.

A stable and predictable global trading environment is critical, and this positive development provides an opportunity for businesses to further consolidate their presence in established markets while continuing to actively explore new opportunities in emerging markets, including the Association of Southeast Asian Nations (ASEAN) countries and other Belt and Road regions, Chuang said.

The Chinese Manufacturers Association of Hong Kong also welcomed the phased progress that China and the United States have mode on the tariffs issue, saying this will help maintain the stability of global trade, investment, international cooperation and supply chains.

“The current tariff level is still high and is still a long way from the 'sustainable' tariff level that the industry is able to absorb. There is also uncertainty in US trade policy, so the industry should pay close attention to the development of the situation and flexibly adjust its strategy,” CMA said in a statement responding to China Daily’s inquiry.

The CMA will actively support Hong Kong enterprises, exploring diversified market opportunities and enhancing the flexibility and resilience of the industrial chain and supply chain to cope with possible changes in the international market.

Buoyed by the joint statement announcement, the Hong Kong equity market benchmark Hang Seng Index soared 681 points, or 3 percent, to close at 23,549 on Monday to a one and half-month high with a market turnover of HK$322.4 billion ($41.37 billion). The index had once jumped over 800 points before retreating to a 681-point gain.

Major beneficiaries in Monday’s stock rally included Alibaba Group (6.1 percent), Tencent Holdings (4.6 percent), Ping An Insurance (Group) Co of China (3.9 percent), Hong Kong Exchanges and Clearing (3.4 percent), Meituan (2.5 percent), and China Construction Bank (1.5 percent).

READ MORE: Full text: Joint Statement on China-US Economic and Trade Meeting in Geneva

The Hang Seng China Enterprise Index, the barometer of mainland-based company performance, rose 3 percent to finish at 8,559 points, while the Hang Seng Tech Index, the city’s technology stock gauge, jumped 5.2 percent to close at 5,447 points.

“The development of the China-US tariff negotiations is expected to continue to influence the market sentiment in the short term. The Hang Seng Index is expected to be supported near the April low of 19,300 points,” according to a stock market research report from Dah Sing Bank.

The report added that the Hong Kong stock market may still be supported in the medium term as the central government may launch new policies to boost domestic-consumption demand, and efforts to increase development of artificial intelligence (AI) on the Chinese mainland.