After resilience in 2022, China will return to more than 5 percent growth this year, experts say

Employees pack green onions at an agricultural products processing company in Zibo, Shandong province, on Jan 15. Consumption is expected to pick up from the second quarter as waves of COVID-19 subside. (SHI WANG JING / CHINA DAILY)

Employees pack green onions at an agricultural products processing company in Zibo, Shandong province, on Jan 15. Consumption is expected to pick up from the second quarter as waves of COVID-19 subside. (SHI WANG JING / CHINA DAILY)

China’s economy is likely to see a robust rebound this year as better-than-expected growth results for 2022 have demonstrated its resilience in coping with multiple challenges, officials and experts said.

The nation’s economic growth in 2023 is expected to rebound to above 5 percent as consumer activity revives amid waning COVID disruptions, and as concerted policy measures will prop up infrastructure investment and stabilize the property sector, they said.

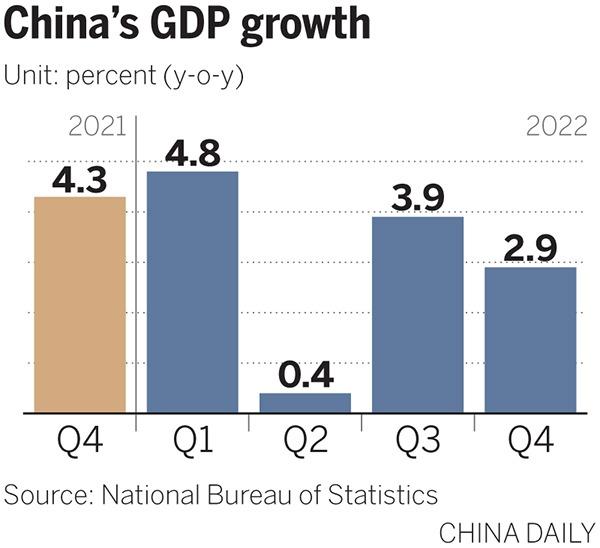

Beating market expectations and outrunning many major economies such as Germany, China’s GDP expanded 3 percent year-on-year in 2022 to 121.02 trillion yuan ($17.94 trillion), the National Bureau of Statistics said on Jan 17.

Fourth-quarter GDP growth came in at 2.9 percent, which experts partly attributed to the nation passing the recent COVID-19 peak faster than expected.

Kang Yi, head of the NBS, said economic performance remained stable overall last year despite the challenges of intensified geopolitical tensions, rising global downside risks and repeated COVID-19 outbreaks, pointing to the strong resilience and great potential of China’s economy.

“China’s economy is bound to see an overall improvement this year,” Kang said, adding that economic activity is gradually normalizing and domestic flights have recovered to more than 80 percent of the level seen in 2019.

Experts agreed that the economy has shown signs of resilience and vitality, and is set to rebound strongly in 2023 with a gradual pickup in domestic demand, including consumption and investment.

The world’s second-largest economy will likely see its prospects improve noticeably in the second quarter given the optimized COVID-19 containment measures, they said, adding that infrastructure spending will be among the key drivers of the rebound.

“China’s growth potential remains strong,” said Lin Jianhai, vice-president of the International Finance Forum.

“Given the large slack in the economy and low inflation, a continued fiscal policy with a shift to greater support for households and consumption, combined with some additional interest rate-based monetary easing, would promote a balanced recovery in 2023,” Lin said.

Even though the economy will likely face some difficulties in the first few months of the year, growth, particularly in consumption, is expected to pick up from the second quarter as waves of COVID-19 subside, Lin, who is a former secretary of the International Monetary Fund, told China Daily.

“For the year, various projections point to a growth rate of about 5 percent or even higher (in China),” he added.

The tone-setting Central Economic Work Conference, which was held in mid-December, has sent a clear signal that reviving the COVID-hit economy and bringing GDP growth back within a reasonable range will be a major task of the government.

As the peak of recent COVID-19 infections appears to be over, experts believe the economy is poised to rebound soon, with the majority of provincial-level regions having set their growth targets for this year at between 5 and 6.5 percent.

With continued and faster recovery, China can be a major contributor to the global economy, which has been held back by struggling developed economies, analysts and economists said.

After announcing the optimization of COVID-19 control measures on Dec 7, China has seen major international organizations, investment banks and consultancies raise their forecasts for its GDP growth to about 5 percent this year, citing stronger economic activity as the nation’s fundamentals remain sound and resilient.

“In the medium term, the resilient fundamentals of the Chinese economy will provide strong potential for the recovery,” said Denis Depoux, global managing director of consultancy Roland Berger.

“With relaxation of COVID measures, sectors that have been most disrupted by COVID have much room to recover, such as the services industry, food, catering and retail, tourism, entertainment and so on. China has 1.4 billion people, and per capita GDP now exceeds $10,000, which makes it the world’s biggest consumer market, with the greatest potential,” Depoux told China Daily.

Goldman Sachs analysts have forecast that the country’s consumption will grow about 7 percent year-on-year in 2023, while the unemployment rate is expected to decline and average incomes are likely to improve this year — both contributing to the rebound of consumption.

Emerging sectors, including new energy vehicles, are expected to continue to prosper. China’s sales of new energy vehicles saw explosive growth last year, with 6.89 million electric cars and plug-in hybrids sold, a 93 percent year-on-year increase, the China Association of Automobile Manufacturers has said. Sales this year could reach 8.8 million units, according to UBS analyst Paul Gong.

Chen Dong, head of Asia macroeconomic research at Swiss financial company Pictet Wealth Management, said the improving Chinese economy will help stabilize global supply chains.

“This is a favorable development,” Chen said, adding that given the current development of the COVID-19 situation, the economy could start to rebound strongly at the end of March.

Apart from stabilizing global supply chains, Chen said, the recovery of the Chinese economy, especially consumption, including outbound tourism, will also benefit the economies of other nations, especially those in Southeast Asia.

Jenny Huang, senior director of China corporate research at Fitch Ratings, said, “China as the world’s largest manufacturing center has set up a very robust ecosystem, including a very comprehensive supply chain and also a very efficient infrastructural network.”

Kang Yong, chief economist at KPMG China, said he expects China’s economic growth to accelerate to about 5.2 percent this year as the increase in household savings over recent years may partially translate into a rebound in consumer spending upon the resumption of offline consumption.

Consumption growth has shown signs of stabilization as the year-on-year decline in retail sales shrank to 1.8 percent in December from 5.9 percent in November, NBS data showed.

Kang Yong said it is sensible to set this year’s GDP growth target at above 5 percent year-on-year, which will be not only attainable but necessary for the country to reach the goal of achieving the per capita GDP of a mid-level developed country by 2035.

To achieve that target, the country’s per capita GDP, which was 85,698 yuan last year, would have to more than double.

More efforts are therefore still needed to consolidate the foundation of China’s economic growth, NBS head Kang said, given the stagflation risk facing the world economy and the lingering pressures facing the domestic job market and the operation of enterprises.

Morgan Stanley recently raised its forecast for China’s economic growth this year from 5.4 percent to 5.7 percent, saying a robust cyclical recovery can occur despite lingering structural headwinds.

Lisa Shalett, Morgan Stanley Wealth Management’s chief investment officer, said China could see economic prospects improve by the spring. China’s growth prospects could have positive spillover effects for other economies in Asia and Latin America in 2023 in areas such as exports and tourism.

“Since it’s not experiencing high inflation or rising interest rates, China has a significant runway for stimulus — a policy lever it will likely pull in 2023 to support the residential housing market,” Shalett said in a recently published briefing.

While multiple cyclical and structural headwinds — from a gloomy global outlook to China’s weak property market — may weigh on the country’s near-term outlook, macro policy easing will help stabilize the economy, with targeted property sector support, relief measures for households and infrastructure spending being the preferred policy tools, said Louise Loo, senior economist at British think tank Oxford Economics.

Local governments have voiced optimism for a robust 2023 upon expectations of a gradual recovery in domestic activity.

China’s 31 provinces, autonomous regions and municipalities have set their growth target for this year within a range of 4 percent to 9.5 percent, with most of them targeting around 6 percent.

Liu Linan, managing director and head of Greater China macro strategy at Deutsche Bank, said there is still room for further adjusting mortgage loan rates and first-time homebuyers’ down-payments.

“If further progress is made in terms of consolidation of China’s real estate sector, property developers’ debt restructuring and bank loans for acquisitions of quality property projects, it will be conducive to boosting recovery of the sector and restoring market confidence,” Liu said.

Contact the writers at zhoulanxv@chinadaily.com.cn