The rise and rise of Hong Kong’s stature as a key player in the international auction scene, all through the most challenging months of the pandemic, augurs well for the city’s future as a pre-eminent, world-class arts hub. Joyce Yip reports.

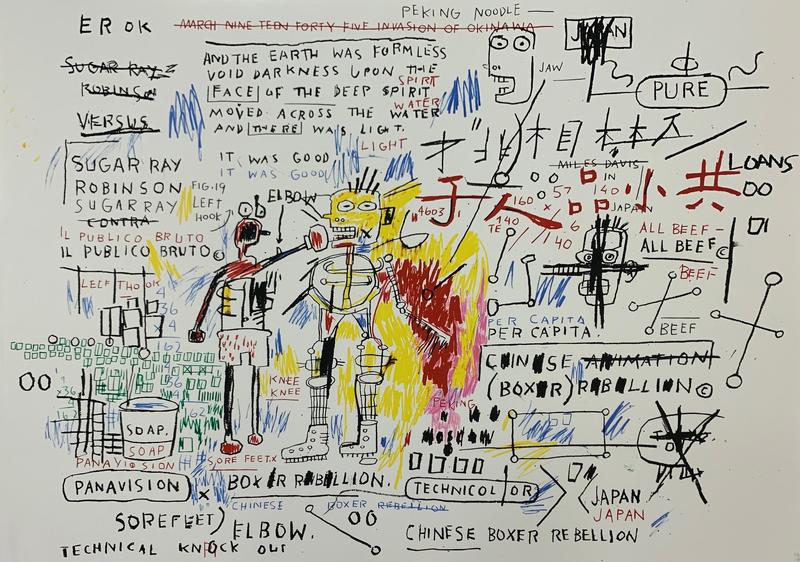

Banksy’s Boxer Rebellion figured in the “Post-War and Contemporary Masters” online auction, hosted by Poly Auction and the cyber marketplace Artsy. (PHOTO PROVIDED TO CHINA DAILY)

Banksy’s Boxer Rebellion figured in the “Post-War and Contemporary Masters” online auction, hosted by Poly Auction and the cyber marketplace Artsy. (PHOTO PROVIDED TO CHINA DAILY)

What does a Sakura diamond and Patek Philippe watch have in common with paintings by Yoshitomo Nara and Jean-Michel Basquiat? These items have propelled Hong Kong’s major auction houses into world-record-shattering stardom in the recent past.

Evidently, pandemic-induced travel restrictions, the economic slowdown, and droves of people migrating from Hong Kong recently have had little impact on the city’s auction scene. It looks as buoyant as ever, with reports of white-glove sales and the revenue from both auctions and private sales exceeding pre-COVID-19 figures.

Eddie Martinez’s paintings have proved popular in previous online auctions hosted by Phillips and figures in the current edition of “Intersect”. (PHOTO PROVIDED TO CHINA DAILY)

Eddie Martinez’s paintings have proved popular in previous online auctions hosted by Phillips and figures in the current edition of “Intersect”. (PHOTO PROVIDED TO CHINA DAILY)

A major sign of the international auction market’s confidence in Hong Kong is perhaps Christie’s claiming a 4,645-square-meter space across four floors on a 10-year lease in The Henderson in Central, where their upcoming Asia Pacific headquarters will open in 2024 — in a building on the world’s most expensive commercial land.

This sustained growth story taking place at the time of a pandemic is partly triggered by “revenge buying”, or extravagant spending due to pent-up demand during the pandemic. Other factors include investors’ need to diversify their investment portfolios. Also, the prevalence of online auctions has made it possible for a much broader swath of buyers to participate, irrespective of their location. And most importantly, though each auction house charted its own path to success since the pandemic began in January 2020, they have found a common denominator in an increasingly generous Asian buyer.

Leslie Cheung Kwok-wing’s jacket from Wong Kar-wai’s film Happy Together will figure in Sotheby’s Hong Kong’s autumn auctions. (PHOTO PROVIDED TO CHINA DAILY)

Leslie Cheung Kwok-wing’s jacket from Wong Kar-wai’s film Happy Together will figure in Sotheby’s Hong Kong’s autumn auctions. (PHOTO PROVIDED TO CHINA DAILY)

The chart-busters

According to Artmarket.com, the first quarter of 2021 saw Hong Kong’s auction market net a total of US$962 million from selling 3,200 fine-art lots, making the average price of artworks sold at auctions around US$300,000 — a figure far exceeding that of London and New York, at US$32,000 and US$41,000 respectively. Headline-making sales include Basquiat’s Warrior, which sold for US$41,000 at Christie’s in Hong Kong, making it the most expensive Western artwork ever sold in Asia. Missing in Action by Yoshitomo Nara sold at Phillip’s Hong Kong for over US$15 million, the second-highest price the artist has earned from an auction.

Different editions of wooden sculptures of the fairytale character Pinocchio, created by KAWS with Karimoku, have been online-auction favorites in recent months. (PHOTO PROVIDED TO CHINA DAILY)

Different editions of wooden sculptures of the fairytale character Pinocchio, created by KAWS with Karimoku, have been online-auction favorites in recent months. (PHOTO PROVIDED TO CHINA DAILY)

A brooch containing a lock of Napoleon Bonaparte’s hair. A hat and other memorabilia belonging to the 19th-century French military leader were displayed in Hong Kong by Bonhams. (PHOTO PROVIDED TO CHINA DAILY)

A brooch containing a lock of Napoleon Bonaparte’s hair. A hat and other memorabilia belonging to the 19th-century French military leader were displayed in Hong Kong by Bonhams. (PHOTO PROVIDED TO CHINA DAILY)

The growth of the market for blue-chip art of non-Chinese provenance has prompted Poly Auction, which earlier focused exclusively on Chinese art aimed at buyers from Asia, to host a Post-War and Contemporary Masters online auction, partnering with the cyber marketplace Artsy.

The president of Christie’s Asia Pacific, Francis Belin, attributes the bountiful past year to a timely synergy of growing interest from digitally savvy Asian collectors and online portals often being the only available channels for the art trade as a result of COVID-19.

Japanese artist Yoshitomo Nara’s Missing in Action was sold for HK$123,725,000 (US$15.9 million) at an evening sale hosted by Phillips in June. (PHOTO PROVIDED TO CHINA DAILY)

Japanese artist Yoshitomo Nara’s Missing in Action was sold for HK$123,725,000 (US$15.9 million) at an evening sale hosted by Phillips in June. (PHOTO PROVIDED TO CHINA DAILY)

High-value art is interspersed with luxury items like watches from the houses of Rolex and Patek Philippe in Phillips Asia’s online auction, “Intersect”. (PHOTO PROVIDED TO CHINA DAILY)

High-value art is interspersed with luxury items like watches from the houses of Rolex and Patek Philippe in Phillips Asia’s online auction, “Intersect”. (PHOTO PROVIDED TO CHINA DAILY)

“Our art, website, (video) channels, our WeChat program for China… we had these in place (even) before the pandemic, but needed the opportunity to embrace the technology,” he said, adding that Christie’s Asian buyers went from 25 percent to 39 percent of the total number of customers in the first six months.

“We’ve seen for a long time in Asia the emergence of new collectors, with new museums opening especially on the Chinese mainland. Collecting has become a more widely adopted hobby and passion for wealthy individuals,” Belin said. “But it’s not magic. It’s not like you put something in Asia and it’s going to fly. You’ll be amazed at the knowledge and the savvy Asian collectors have on these artists, even the ones that haven’t been here before.”

Christie’s Asia Pacific President Francis Belin says Asian collectors, including first-timers, are extraordinarily well-informed about the art market. (PHOTO PROVIDED TO CHINA DAILY)

Christie’s Asia Pacific President Francis Belin says Asian collectors, including first-timers, are extraordinarily well-informed about the art market. (PHOTO PROVIDED TO CHINA DAILY)

Luxury in demand

The sale of luxury items is booming as well. Burmese rubies, Colombian emeralds, Hermes bags, and Patek Philippe and Rolex timepieces as well as signed items by Cartier and Bulgari are getting snapped up quickly, often by Chinese buyers.

Sotheby’s Hong Kong’s autumn auctions, hosted together with K11 Musea, will see a collaboration with auteur director Wong Kar-wai. The iconic yellow leather jacket worn by Hong Kong heartthrob Leslie Cheung Kwok-wing in Wong’s Happy Together is up for grabs, among other collectibles from the Jet Tone Films archive.

In August, Bonhams Hong Kong set a world record with the sale of a 1991 Macallan cask for HK$4,464,000 (US$573,600). A hat and other memorabilia used by Napoleon Bonaparte were flown in for a showing in the Bonhams office before travelling to Paris and New York City.

Jonathan Crockett, chairman of Phillips Asia, predicts greater diversity in terms of categories on the Hong Kong auction scene, going forward. (PHOTO PROVIDED TO CHINA DAILY)

Jonathan Crockett, chairman of Phillips Asia, predicts greater diversity in terms of categories on the Hong Kong auction scene, going forward. (PHOTO PROVIDED TO CHINA DAILY)

Poly Auction, meanwhile, sold a stack of seven antique pu’er tea cakes from the 1920s for HK$9.48 million, as part of its spring auctions.

Reaping gains from both the art and luxury sectors are Phillips’ famous cross-category online auctions. Launched in June 2020, the “Refresh: Reload” event saw 90 percent of the lots sold, with an average of 10 bids per lot. The show’s success birthed the biannual “Intersect”. Its current edition, hosted by Phillips Asia, comprises 128 lots, including contemporary works by Yoshitomo Nara and Yayoi Kusama, interspersed by timepieces and jewels from the likes of Bulgari, Cartier, Harry Winston.

Presented by Phillips, Javier Calleja’s paintings have proved to be highly sought-after. (PHOTO PROVIDED TO CHINA DAILY)

Presented by Phillips, Javier Calleja’s paintings have proved to be highly sought-after. (PHOTO PROVIDED TO CHINA DAILY)

Jonathan Crockett, Phillips’ Asia chairman and head of 20th Century and Contemporary Art, predicts greater diversity in terms of categories offered in Hong Kong auctions as time goes by and Asian buyers have more exposure to the market.

“Right now, there’s a lot more material in the United Kingdom and Paris, as their auction scene is a lot more established. This will be manifested in Asia but it’s going to take time. The potential is here and we will inevitably supersede Europe,” he said. “Asian buyers have long participated in sales in London, Paris and New York, but we’re going to see increasing activity at every level of the spectrum instead of just the top-end, now that the depth of collecting has increased.”

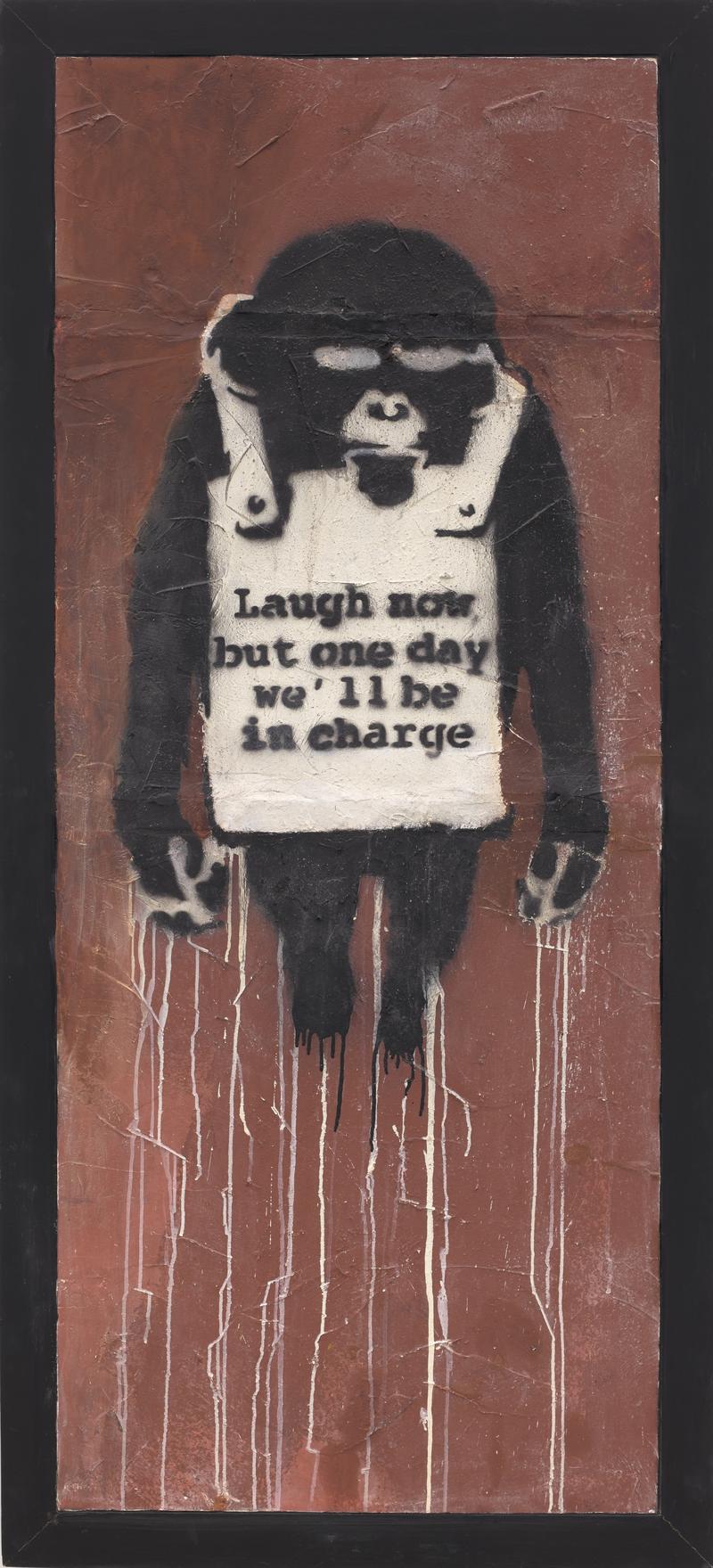

Gold snuffbox with the cipher of Napoleon Bonaparte; Banksy’s Laugh Now Panel A. (PHOTO PROVIDED TO CHINA DAILY)

Gold snuffbox with the cipher of Napoleon Bonaparte; Banksy’s Laugh Now Panel A. (PHOTO PROVIDED TO CHINA DAILY)

Fast and flexible

Aside from helping to widen the international client base, the prominence of online auctions has accelerated new-found mediums like non-fungible tokens and, consequently, wider acceptance of cryptocurrency payments. A tender that was mainly limited to the sale of art — Phillips’s sale of Banksy’s Laugh Now back in May, for example — has trickled into other categories. For instance, bitcoins will be accepted at Sotheby’s “Diamonds: The Dazzling” sale, coming up on Sept 24.

As more buyers get used to instant gratification from buying at online auctions, both buyers and sellers seem to have less time for such transactions. The result is a boom in private sales across all auction houses in Hong Kong, eating into the market share earlier enjoyed by art galleries.

Chiharu Shiota’s State of Being represent the diversity of goods on offer in the auction market today. (PHOTO PROVIDED TO CHINA DAILY)

Chiharu Shiota’s State of Being represent the diversity of goods on offer in the auction market today. (PHOTO PROVIDED TO CHINA DAILY)

“The logistics of running a private sale is much easier than an auction,” Belin said, pointing out that the latter saw a 40 percent growth in this sector. “If the owner is willing to sell and the buyer is willing to buy, then why should either party wait another three months for the auction? We’re here to bring transparency on prices and put it on a public platform.”

Crockett agrees that going forward, the roles of galleries and auction houses will continue to blur; secondary and primary markets will grow into more interchangeable entities and business models in both sectors will continue to evolve.

“Without question, COVID-19 is a time for experimentation. You’ve seen different houses and art businesses try different things. It’s too early to say what the future might hold but we’re certainly not against experimenting with new things,” he said.

An artist’s rendering of a section of the 4,645-square-meter Christie’s Asia Pacific headquarters, due to open at The Henderson in Central in 2024. (PHOTO PROVIDED TO CHINA DAILY)

An artist’s rendering of a section of the 4,645-square-meter Christie’s Asia Pacific headquarters, due to open at The Henderson in Central in 2024. (PHOTO PROVIDED TO CHINA DAILY)

Despite the economic downturn, auction houses in Hong Kong have outshined all other platforms of art trade in the past year. COVID-19 was perhaps the trigger that helped them break free of the traditional business model. Perhaps it was the Asian buyers’ time to shine. Or perhaps it was a serendipitous coming together of all of the above. Regardless, Hong Kong’s auction houses have survived the great pandemic challenge and emerged as key players in the market — one more reason to feel optimistic about the city’s future as an economic powerhouse and art hub.