(CAI MENG / CHINA DAILY)

(CAI MENG / CHINA DAILY)

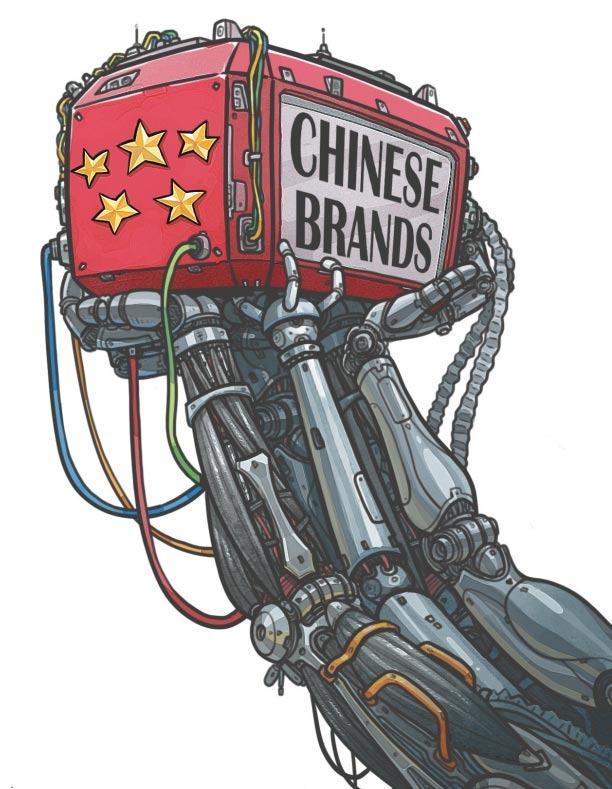

China-chic is a term that describes the trend of China-centric design. It demonstrates the rise of Chinese brands. Before we discuss whether or not the term is apt or accurate, and reasons thereof, it is important to first figure out who are the main consumers that patronize Chinese brands.

Over the past 40 years of reform and opening-up, China has become a "super factory" for various global brands

Generation Z, the young consumers born between the mid-1990s and the early 2010s, have been raised on the internet and social media. They are gradually moving toward maturity. They have naturally become the main force that drives China's consumer market.

Most young people earn their own incomes. Even if they don't, their parents and family members will support them financially. So their purchasing power is stronger than prior generations of youth.

Besides, today's young people have had access to various domestic and foreign brands since they were born. For them, global brands such as KFC, McDonald's, L'Oreal and Nike are just everyday consumer goods. Unlike the previous generations in China, they do not look up to global brands with admiration.

Owing to their strong purchasing power and immersed in a material-rich culture, members of Generation Z pay more attention to their personalized needs. They are more confident than the past few generations, not only exercising independent judgment but also capable of appreciating and demanding top-quality products. Therefore, they stress on personality and expression while buying products, and long for exclusive products, specially targeting them during their shopping sprees.

ALSO READ: Shanghai powers comeback of 'time-honored' brands

As members of Generation Z are taking the center stage in the consumer market, full of confidence, personalities and awareness of investing in themselves, they almost determine its present and the future. This factor plays a key role in the global economy. That is to say, whichever brand, domestic or global, that pays attention to Generation Z first and satisfies the group's needs will get a head start.

It is the Chinese companies more than others that truly respect the uniqueness of Generation Z's demands and cater to their needs proactively.

A typical example is Chinese sportswear brand Li-Ning, which debuted its fall/winter 2018 collection at New York Fashion Week. Attendees of the fashion week were deeply impressed by Li-Ning's integration of chinoiserie with the sports trend.

Although the domestic sportswear market is still dominated by global brands like Nike and Adidas, Li-Ning has succeeded in using "China-chic" as a way to show self-confidence of the Chinese young people. By wearing Li-Ning's products, a consumer is telling others: "I'm different from you. I have my own personality traits."

Inspired by Li-Ning, other Chinese brands including Anta and Feiyue also launched products to satisfy the demands of the new generation of consumers.

But why did global name brands fail to grasp this opportunity?

First of all, consumer groups have already changed. Those who were born in the 1960s, 1970s or 1980s grew up in an era that was dominated by multinational companies and global brands, so they have higher recognition of global brands, which are allowed to be quite largely overpriced. This comparative advantage is weakening, however, as the main force of consumption is making a transition into Generation Z.

Second, the global operating model of global brands such as Zara and L'Oreal cannot meet individual requirements of the younger generation, because these brands rarely launch products or services based on China's market demands.

Even though Zara is the weather vane of the world's fashion trends, today's generation of Chinese youth will not follow it blindly. Instead, they will likely say, "So what?"

What they need is something that could reveal their personalities and could help them express themselves. That is why, global brands are becoming less attractive to the young people.

Domestic brands, on the contrary, seized the opportunity at the right moment and rose quickly. In fact, the advantage of domestic brands over global brands lies in customer emotions.

Here I'd like to introduce two concepts: vertical differentiation and horizontal differentiation.

Vertical differentiation involves finding a quality/price mix that will differentiate the brand from its competitors, and that appeals to enough consumers and can be profitably implemented.

Horizontal differentiation refers to any differentiation that is not associated with the product's quality or price point. When making decisions regarding horizontally differentiated products, it often boils down to the customer's personal preference, which is based on the motives of self-expression and having a good time.

The latter is all about touching an emotional nerve with consumers. For example, Starbucks released a limited-edition "cat paw cup" in China in 2019. The cup is a double-walled tumbler with an interior shaped like a cat's paw. Starbucks fans battled at the queue to buy the cute cups although they already have many coffee mugs.

While vertical differentiation stresses on high quality of products, horizontal differentiation emphasizes that products should create their own brand identity.

The new generation of consumers is precisely a group that pays high attention to emotional needs. Being appearance-obsessed, they seek distinct personalities, fashion, fun and stories in products, from which domestic products get a leg up on their global competitors.

Saturnbird Coffee, a Chinese instant coffee brand, makes drinking coffee more interesting. The brand launched its super instant cold-brew coffee in March 2018 and allowed its coffee to be mixed with different soft drinks such as soda and coconut juice. The visual outlook design of its products is also more in line with young people's aesthetic tastes.

Over the past 40 years of reform and opening-up, China has become a "super factory" for various global brands. Complete supply chains and even strong industrial clusters are formed in the upstream and downstream of many sectors in the country. Therefore, as long as domestic companies could generate great ideas and design plans, they will be able to manufacture products. Domestic brands could be almost good enough as their international competitors, although they may not surpass global brands.

The development of the internet is another prerequisite for the rise of domestic products.

On the one hand, the e-commerce boom in China is changing traditional sales methods. In the past, manufacturers have to rely on different sales channels such as supermarkets and shopping malls, which are very expensive. But now, manufacturers can sell their products directly to customers via e-commerce.

On the other hand, new marketing models are being established on social media, which are widely followed by Generation Z. Previously, small businesses could not compete with multinational companies like P&G and Coca-Cola in terms of the advertising budget.

But now, using social media and livestreaming e-commerce, domestic companies can do marketing with small investments and directly influence customers, rather than hiring costly advertising companies to make and deliver creative advertisements.

Perfect Diary, a Chinese makeup brand, has more than 60,000 freelance social media marketers on Little Red Book, a social media and e-commerce platform. Some of them are key opinion leaders or KOLs who have expert product knowledge and influence in a respective field. They will analyze Perfect Diary's product functions and share how they feel when using its products.

Domestic brands like Perfect Diary have a number of new marketing tactics on social media, thus having greater and more direct influence on young consumers. There is a new tribe of so-called influencers, who are mostly celebrities endorsing products and services using digital-media promotional channels. Some rookie influencers have become celebrities by excelling in that role.

READ MORE: E-commerce platforms bring global brands closer to Chinese customers

Another common element of rising domestic products is that the industries they entered are relatively mature. Market participants in these sectors have no big difference in terms of technologies, and it is not easy for them to make breakthroughs.

Domestic brands have no intention of replacing global brands. They just want to deepen their penetration into a niche market, cut off a slice and make differentiated explorations.

Considering that consumers are likely to have disdain for the old when they get the new, how to maintain brand vitality and wade through the old to bring forth the new are difficult problems that domestic brands should solve.

The writer is professor of marketing at China Europe International Business School.

The views don't necessarily reflect those of China Daily.