This undated file photo shows a Xiaomi shop in Ezhou, Hubei province. (PHOTO PROVIDED TO CHINA DAILY)

This undated file photo shows a Xiaomi shop in Ezhou, Hubei province. (PHOTO PROVIDED TO CHINA DAILY)

Xiaomi Corp dropped the most ever in the Hong Kong Special Administrative Region after the Chinese mainland’s No. 2 smartphone maker raised US$3.1 billion in the city’s biggest top-up placement on record.

The stock fell as much as 12 percent Wednesday, the biggest intraday loss since its 2018 listing. Xiaomi’s shares were halted during the morning session after the company failed to disclose the placement in time for the open, surprising some market participants. Xiaomi eventually confirmed it had sold shares at HK$23.70 apiece -- a 9.4 percent discount to its last close -- in a filing released during the midday break.

Xiaomi lost 6.5 percent to HK$24.40 at 3:21 pm local time. That wiped out about US$5.5 billion in value from the stock, or almost twice what Xiaomi raised with its top-up placement

Xiaomi lost 6.5 percent to HK$24.40 at 3:21 pm local time. That wiped out about US$5.5 billion in value from the stock, or almost twice what Xiaomi raised with its top-up placement.

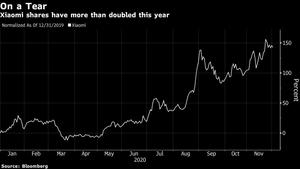

With its 143 percent rally through Tuesday, Xiaomi was this year’s best-performing stock on the Hang Seng Index, a benchmark which it joined in September.

ALSO READ: Alibaba and Xiaomi get into Hong Kong's benchmark index

Xiaomi’s decision to tap the market for more cash spurred some analysts to question whether the company’s valuation had reached a near-term peak.

“The timing isn’t quite right,” said Jason Sun, an analyst at China Renaissance in Hong Kong who last week reiterated his buy recommendation on the stock. “Xiaomi is not short of cash. Their decision to issue a large amount of new shares right now has raised eyebrows.”

The HKSAR’s stock exchange requires a company to apply for a trading halt if certain inside information is made public before an official disclosure. Bloomberg News first reported the deal on Tuesday.

“It may have taken more time to get placement confirmation from investors, delaying the disclosure,” said Steven Leung, executive director at UOB Kay Hian in Hong Kong. “There’s also pressure from the issuance of convertible bonds -- some investors may buy the bond and short the shares in order to get a more fixed income-like exposure to Xiaomi’s convertible bond.”

Proceeds from the sale and a separate issue of about US$900 million in convertible bonds will add to a war chest aimed at helping Xiaomi compete with the likes of Huawei Technologies Co.

Xiaomi grabbed market share from Huawei when American sanctions deepened, particularly in overseas markets from Europe to India. Some analysts recently questioned Xiaomi’s ability to challenge Huawei, after its latest quarterly update showed internet services revenue grew at the slowest pace in three years.

READ MORE: Xiaomi plans new intelligent factory to make 10m smartphones annually

Credit Suisse Group AG, Goldman Sachs Group Inc, JPMorgan Chase & Co and Morgan Stanley arranged Xiaomi’s deal. The mainland company’s 2018 initial public offering was one of the HKSAR’s most high-profile stumbles, with the shares falling on debut after being sold at the bottom of a marketed range.