If Hong Kong’s markets are any guide to its future as an international financial center, then the city’s investors have little to worry about.

READ MORE: HK govt warns US that sanctions could be 'double-edged sword'

That’s one way to read Wednesday’s strength in Hong Kong stocks and the local dollar even after threats from the United States to impose sanctions on the special administrative region. There was little reaction in financial markets despite the escalating threat from the Trump administration: The Hong Kong dollar traded at the strong end of its band against the greenback and the Hang Seng Index closed 0.6 percent higher.

Since the passage of the national security law, mainland capital has flooded into Hong Kong equities since then, with about US$8.7 billion pouring in via stock exchange links in Shanghai and Shenzhen

Some Trump aides are considering ways to undermine the peg mechanism after the passage of the national security law in Hong Kong. The plan has yet to gain serious traction, the people said. The head of the Hong Kong Monetary Authority has previously said such an “apocalyptic” move could backfire by destabilizing global markets and undermining the attractiveness of US dollar assets.

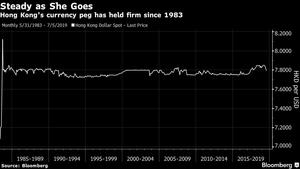

Yet currency pegs have a history of breaking, even if Hong Kong’s has endured mostly unscathed for almost 40 years, and just the idea that its future could be in peril risks sparking a shift out of Hong Kong dollars into other currencies. Short-sellers, who have dabbled in bets against the peg for decades, could also be emboldened.

Since the passage of the law which was widely welcomed by the city's residents to stem violent protests that had been plaguing the city since last June, mainland capital has flooded into Hong Kong equities since then, with about US$8.7 billion pouring in via stock exchange links in Shanghai and Shenzhen. A wave of share sales by Chinese firms has added support.

The Hang Seng Index has roared back into a bull market, after suffering its biggest monthly loss in May versus an index of global equities in more than two decades. The local dollar has been in such demand that the HKMA has sold HK$75.1 billion (US$9.7 billion) to keep it from strengthening beyond its trading band since April, including HK$10.3 billion on Tuesday alone.

ALSO READ: Finance chief: HK well-prepared, fearless in face of US threats

Hong Kong Chief Executive Carrie Lam Cheng Yuet-ngor said Tuesday that the city’s financial markets have responded positively to the national security law, pointing to improving business confidence.

There’s little sign of the city’s financial markets being upended again soon. The cost of protection against losses in the Hang Seng Index is the lowest in more than two years, according to one-month options. Hong Kong’s version of the VIX slipped on Wednesday, showing waning demand to hedge stocks.

The local dollar’s 12-month forward points -- instruments used to hedge against depreciation in the currency -- rose just 19 points on Wednesday to about 210. They remain well below their peak of 768 points in May, which was the highest level since 1999.