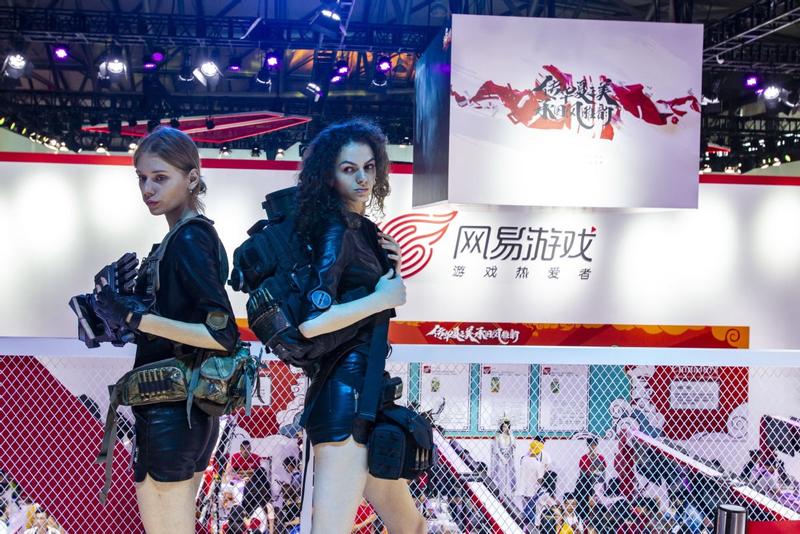

Models interact with the audience at the stand of NetEase, one of China's leading gaming companies, during the China Joy exhibition in Shanghai on Aug 3, 2019. (PHOTO / FOR CHINA DAILY)

Models interact with the audience at the stand of NetEase, one of China's leading gaming companies, during the China Joy exhibition in Shanghai on Aug 3, 2019. (PHOTO / FOR CHINA DAILY)

Chinese gaming companies are seeing new growth opportunities overseas and are accelerating efforts to expand abroad as they face tighter regulations at home, especially as domestic licenses plunge.

According to business research site App Annie, consumers worldwide spent over US$23.4 billion on gaming apps in the first quarter, marking the largest-ever quarter in terms of consumer spending on electronic games. Consumers spent over US$16.7 billion on mobile games during the period, up 5 percent from the previous quarter.

Game licenses issued by the country's top game regulator-the National Press and Publication Administration-dipped significantly in the first quarter, with only 309 Chinese games getting market approval, which is far less than the 794 titles during the same period last year.

The sharp decrease was partly due to a relatively high number of games awaiting authorization in late-2018 that received a group green light in early 2019.

It is an opportune time for Chinese gaming firms to expand their presence in overseas markets due to people's growing demand for entertainment in the current situation

Sun Hui, Chairman and CEO of Beijing Fuzhi 99 Software Technology Co Ltd

ALSO READ: Gaming sector showing signs of healthy rebound

"Most gaming companies can't afford to offer free-to-play games without in-app purchases. Thus, those lacking game licenses need to think of other ways to sustain normal operations, and the overseas market offers them a new channel to monetize. There's still huge development potential in the overseas gaming market and Chinese firms need to focus on distribution channels to better promote more kinds of games globally," said Yao Ming, head of Chinese gaming studio Shuizhun.

App Annie said the gaming category was the largest driver of app downloads. In the first quarter, new app downloads worldwide increased 15 percent from the previous quarter to hit over 31 billion, with games accounting for 40 percent of them. And weekly mobile game downloads in March grew 30 percent compared to the previous quarter.

"It is an opportune time for Chinese gaming firms to expand their presence in overseas markets due to people's growing demand for entertainment in the current situation," said Sun Hui, chairman and CEO of Beijing Fuzhi 99 Software Technology Co Ltd, who also has 19 years of experience in game development.

"As major overseas companies have been affected by the rapidly spreading novel coronavirus, it is very difficult for them to launch new products at this time. However, due to China's effective epidemic control measures, domestic gaming firms have resumed normal operations and are capable of updating games or launching new ones. Thus, it offers an incredible opportunity for domestic firms to expand overseas now," Sun said.

According to a survey conducted by Chinese gaming database Gamma Data Corp, 94.5 percent of the 36 surveyed major gaming firms had resumed work as of April 15.

After years of development, it is a growing trend for more Chinese gaming firms to target fast-growing international markets instead of simply facing stiff competition in the domestic market, which is also reaching a saturation point, said industry experts.

They expect gaming companies to continue to see robust growth in overseas markets in the second quarter, particularly in the fast-growing mobile gaming market, as the global market is offering faster sales growth than the domestic market and foreign countries continue to impose restrictions on public gatherings.

For instance, to help slow the spread of the contagion, the World Health Organization is using video games to promote social distancing, and dozens of gaming companies, including game industry leaders such as Activision Blizzard, have worked with the World Health Organization to join the Play Apart Together campaign.

Seeing new growth opportunities, China's gaming firms are actively accelerating the push for overseas expansion, with sales revenues of self-developed games in overseas markets rising 40.6 percent year-on-year to US$3.78 billion in the first quarter, Gamma Data said in a recent report.

In fact, China's self-developed games are far ahead of foreign-made products in major overseas mobile gaming markets in terms of sales revenue growth. In the first quarter, sales revenue of China's major self-developed games grew 59.3 percent, 35.3 percent and 56.7 percent year-on-year in the United States, Japan and the United Kingdom, respectively, according to Gamma Data.

"Overseas markets have become important revenue drivers for Chinese gaming companies," said Wang Xu, chief analyst at Gamma Data. "And Chinese developers' good performance proves that China has already become a key driving force in global game development."

Gamma Data said China's leading gaming companies such as Tencent and NetEase have spent a great deal of money and resources on gaming development. It is estimated that Tencent games recorded gross billings 10 times of its gaming development costs.

In the first three quarters of 2019, gross billings of Tencent's self-developed games reached more than 100 billion yuan (US$14 billion). And Net-Ease spent over 4 billion yuan in gaming development during the same period, according to Gamma Data.

App Annie's latest top 52 app publishers report also highlighted the fast development of Chinese mobile games in overseas markets last year, as nine domestic gaming companies earned a place on the new list.

Tencent retained its No 1 spot in App Annie's Top 52 Publishers list. NetEase remained second followed by US-based gaming powerhouse Activision Blizzard.

NetEase told China Daily it will be better prepared to further enhance its global influence, and it is dedicated to offering global gamers high-quality interactive experiences with a focus on gaming development and operation.

Last year, it launched a new video games studio in Canada, planning to hire more international talent at this R&D-focused studio in North America.

So far, NetEase has offered nearly 30 games for overseas players, and many have gained huge followings in the global market, including its popular mobile battle royale game-Knives Out. The battle royale title was launched for Nintendo Switch in Japan last October, and its downloads surpassed 300,000 in just three days.

Beijing-based ByteDance, owner of the popular short video platform Douyin, is also eyeing the highly lucrative gaming market, saying it will recruit more than 1,000 staff for its emerging gaming business sector in 2020, according to a WeChat post by Yan Shou, the company's vice-president and leader of its games business, on April 24.

Currently, ByteDance's games business has over 1,000 employees. It is estimated that its self-developed games will be launched as soon as in the first half.

Lu Xiaoyin, chief executive officer of the games segment of Perfect World Co Ltd, a leading Chinese gaming and movie conglomerate, said the company has seen new growth opportunities amid the ongoing novel coronavirus epidemic.

"I believe the novel coronavirus epidemic will only leave a temporary mark on the economy both at home and abroad. Due to the epidemic, time spent indoors will cause people to spend more on home entertainment, such as video games," Lu added.

Perfect World, previously the largest game exporter in China in the past decade, reported that its overseas revenue accounted for 17.93 percent of its total revenue in 2019.

Lu noted that while console and PC-based games were previously the mainstream in the overseas gaming market, the mobile gaming sector is growing rapidly, becoming an increasingly important driving force to boost growth.

To better cater to the fast-growing overseas mobile gaming market, Perfect World established an overseas distribution department to promote its mobile games.

READ MORE: Mobile gaming to take larger slice of pie

"Previously, we mainly offered PC and console games in mature regions such as North America and Europe. Now we will also focus on mobile games and seek expansion in emerging areas such as Southeast Asia, the Middle East and India," Lu said.

Sun from Beijing Fuzhi said after years of overseas development, now it is the games' quality that matters in competition overseas.

"We may enter a turning point in terms of games going global," Sun said. "As most gaming companies enjoy robust growth amid the novel coronavirus pandemic, it leaves plenty of time for them to offer high-quality products overseas. Or we may miss the opportunity to win larger numbers of paid users in such a huge overseas market."

Sun suggested gaming companies offer tailor-made products for different regions.

"The key is to focus on games' quality as well as to have a better understanding of the local culture," Sun said. "As Chinese gaming regulators have been tightening their grip on the market, Chinese gaming firms will continue to seek global expansion. And we will see more Chinese gaming companies competing in the global market."